Two ways of thinking about the Phillips curve - 5 minutes read

There are two ways of thinking about the Phillips curve relationship:

There are two ways of thinking about the Phillips curve relationship:Irving Fisher invented the Phillips curve back in the early 1920s, and employed the first interpretation. Milton Friedman also approached it that way, although he refined the model by emphasizing unanticipated changes in inflation. In a world of sticky nominal wages, an unanticipated fall in inflation tends to raise real wages, resulting in more unemployment.

New Keynesians use the second interpretation. In their view, higher unemployment creates “slack”, which drives inflation lower. That’s become the standard approach, although I’ve never liked it for reasons I’ll explain in a moment.

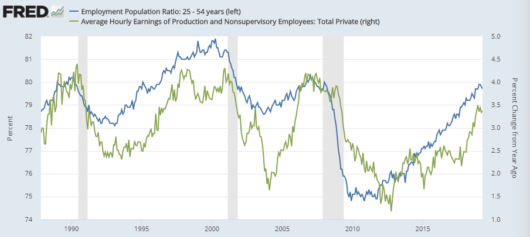

Greg Mankiw has a new post that suggests the Phillips curve is alive and well. Interestingly, he uses nominal wages:

Reading Mankiw’s post I suddenly got a brainstorm. Start with the fact that inflation is obviously not the right variable for the Phillips curve. Every day that goes by, that becomes more and more obvious to me. But what is the right variable? There are two directions one could go, depending on whether one wants to highlight the Fisher/Friedman approach, or the New Keynesian approach.

Mankiw points to a paper that he co-authored with Ricardo Reis to justify the use of nominal wages. I think he’s right that wages are the correct nominal aggregate in the new Keynesian model, not prices. If you want to argue that slack reduce inflation, it’s most likely to show up in wages, as prices reflect both AS and AD shocks. And wages are stickier than prices, and thus a better target for monetary policy.

Using the Fisher/Friedman interpretation of Phillips curve causality (nominal shocks have real effects), NGDP is the right nominal aggregate. Recall that nominal wages are sticky in the Fisher model, and unexpected changes in inflation cause movements in real wages, and hence unemployment. But that’s obviously much more true of NGDP than price inflation. Unexpected NGDP shocks clearly do drive changes in employment when wages are sticky. Again, price inflation reflects both AS and AD shocks.

So we have a world where the true model of the economy is all about NGDP and nominal wages. NGDP shocks in a country with sticky wages create business cycles. But we’ve weirdly decided to use an ambiguous intermediate variable—price inflation—which is sort of like NGDP and sort of like wage inflation. Because it is ambiguous, its causal role in the Phillips curve model can be interpreted in two radically different ways, as either the cause of business cycles or the result of business cycles.

If we dump the ambiguous price inflation from macro and replace it with the very unambiguous NGDP and nominal wages, we get a much clearer sense of what’s going on. Cause and effect are immediately obvious.

PS. I can’t even imagine what our undergraduates make of textbook macro. Taken as a whole, it MAKES NO SENSE. Inflation comes from MV=PY? Or does it come from having less “slack”? If you replace the textbook model with NGDP and wages, everything suddenly becomes clearer. Monetary policy (including velocity shocks) drive NGDP. Real GDP fluctuations are caused by NGDP fluctuations interacting with sticky wages. And once you have growth rates for NGDP and RGDP, then price inflation is simply the difference.

PPS. Sorry for being so long-winded. I wish I could write like Mankiw, a man of few words. Or zero words in the post I linked to, to be precise.

PPPS. If only I could write my own textbook. Oh wait, I did.

. . . If only I could write a textbook without worrying about sales figures.

This entry was posted on June 23rd, 2019 and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response or Trackback from your own site.

Source: Themoneyillusion.com

Powered by NewsAPI.org

Keywords:

Phillips curve • Irving Fisher • Phillips curve • Milton Friedman • Economic model • Inflation • Nominal rigidity • Real versus nominal value (economics) • Inflation • Real wages • Unemployment • New Keynesian economics • Unemployment • Inflation • Greg Mankiw • Phillips curve • Real versus nominal value (economics) • Wage • Brainstorming • Inflation • Phillips curve • Irving Fisher • Milton Friedman • New Keynesian economics • Ricardo Reis • Real versus nominal value (economics) • Wage • Wage • Real versus nominal value (economics) • Aggregate demand • New Keynesian economics • Price • Inflation • Wage • Price • Advertising • Wage • Price • Monetary policy • Irving Fisher • Milton Friedman • Phillips curve • Causality • Real versus nominal value (economics) • Shock (economics) • Real versus nominal value (economics) • Causality • Rights • Real versus nominal value (economics) • Aggregate demand • Real versus nominal value (economics) • Nominal rigidity • Irving Fisher • Real wages • Unemployment • Truth • Inflation • Employment • Wage • Nominal rigidity • Inflation • Advertising • Economic model • Economy • Real versus nominal value (economics) • Nominal rigidity • Business cycle • Inflation • Real wages • Ambiguity • Causality • Phillips curve • Conceptual model • Causality • Business cycle • Business cycle • Ambiguity • Inflation • Macroeconomics • Gross domestic product • Wage • What's Going On (song) • Causality • Pound sterling • Macroeconomics • Inflation • Equation of exchange • Economic model • Wage • Monetary policy • Velocity of money • Real gross domestic product • Nominal rigidity • Inflation • If Only I Could (TV series) • If Only I Could (TV series) • RSS • Trackback •