Shale Oil Well Productivity Stalls Putting Growth Estimates At Risk - 5 minutes read

Shale Oil Well Productivity Stalls Putting Growth Estimates At Risk

Shale Oil Well Productivity Stalls Putting Growth Estimates At RiskThis means in order to keep the same pace of growth, US shale producers have to complete more wells, which equates to higher capex spending.

But with the capital markets shut off for shale producers and investors demanding disciplined capex spending, the treadmill decline will catch up.

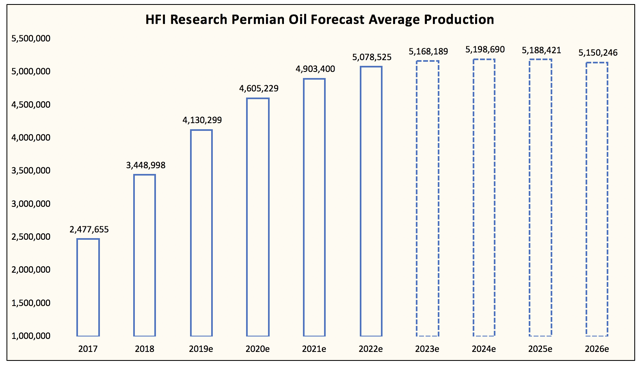

We estimate that if US shale producers do not increase well completions, then the Permian will peak by 2023/2024, Bakken by 2020, and the Eagle Ford by 2021.

This is thanks to the treadmill effect which puts the long-term US shale production growth projections at risk.

Welcome to the at-risk edition of Oil Markets Daily!

EIA's latest drilling productivity report was released today and well productivity estimates were revised lower for the Permian and Eagle Ford.

As a whole, if US shale oil basins complete the same amount of wells as 2018, then we will see production rise y-o-y by ~1 mb/d.

This is, however, a 200k b/d downward revision we had for 2019. In addition, as you can see, 2020 growth estimates fall more even as US shale is expected to complete ~5% more wells y-o-y. The reason is because of the "treadmill effect" of flush production meeting steep production declines in year one.

On the well productivity side, we are seeing the Permian basin starting to stall:

While we still expect the Permian to be the biggest growth contributor going forward, the speed and pace of the growth will start to level-off materially.

By our estimate, if the Permian doesn't see a sizable step change upward in well completions, then we will see production growth level out by 2023/2024.

The same could be said of the Bakken which we estimate to show peak production in 2020 and the Eagle Ford, which we see peak production in 2021.

Both of these basins are also struggling with well productivity growth.

To make matters worse, the Bakken also appears to be draining DUCs, which is what's likely keeping productivity stable. We suspect the new wells drilled today will not be as productive as some of the DUCs being completed.

Combining everything, and we can quickly see how US shale oil well productivity is stalling.

We observed the peak in productivity in September last year.

And on a y-o-y basis, we can see how the growth is about to go negative.

The logic behind the treadmill analogy is simple.

US shale producers can bring an oil well into production in a short amount of time, but the parabolic decline curve makes it so that year 1 of production declines on average over ~70% from peak to trough.

As US shale oil production grows, the base of the production grows. The faster the growth, the steeper the decline. The slower the growth, the shallower the decline.

Because US shale grew ~1.5 mb/d last year, more than 15% of the production base coming into this year will exhibit that steep decline curve. So the speed of the treadmill increased.

And as US shale continues to grow, more and more capex has to go into replacing the decline. So the speed of the treadmill is the existing decline.

Eventually, as the decline curves catch up, almost all of the spending each year will go towards replacing the decline. We estimate the year for that is 2023 for the Permian, 2020 for Bakken, and 2021 for the Eagle Ford.

Obviously, if US shale producers want to grow production, then either 1) well productivity needs to improve or 2) complete more shale wells.

The well productivity side is harder to accomplish given that US shale producers are already targeting tier 1 acreages and achieving peak productivity, so the only solution to higher growth is by completing more shale wells.

The issue is that to complete more wells, you need to spend more capex. And to spend more capex, you need to spend outside of your cash flow. This requires shale producers to access the capital market, which is no longer available even for the leanest of producers. In addition, investor pressure on disciplined capex spending means less capex, not more.

This combined with the increasing treadmill effect will be the ultimate drag on US shale production. This doesn't mean US shale production won't grow this year, but it means that when it does stop growing, it will do it in a blink of an eye and catch the world off guard.

Disclosure: I am/we are long UWT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Tight oil • Oil well • Productivity • Economic growth • Economic growth • Shale • Capital expenditure • Capital market • Shale • Capital expenditure • Shale • Permian • Bakken Formation • Eagle Ford Group • Treadmill • Shale • Petroleum • Energy Information Administration • Permian • Eagle Ford Group • Tight oil • Oil well • Shale • Treadmill • Permian Basin (North America) • Oil well • Completion (oil and gas wells) • Bakken Formation • Peak oil • Eagle Ford Group • Peak oil • Sedimentary basin • Water well • Bakken Formation • Oil well • Tight oil • Oil well • Logic • Treadmill • Shale • Oil well • Dune • Crest (physics) • Tight oil • Slope • Shale • Slope • Treadmill • Shale • Capital expenditure • Treadmill • Permian • Bakken Formation • Eagle Ford Group • Shale • Oil well • Primary production • Shale • Water well • Water well • Shale • Productivity • Shale • Capital expenditure • Capital expenditure • Cash flow • Shale • Capital market • Capital expenditure • Capital expenditure • Treadwheel • Shale • Shale • Seeking Alpha •