Joe Biden's Twitter fight with Amazon perfectly sums up the battle over America's new tax code - 4 minutes read

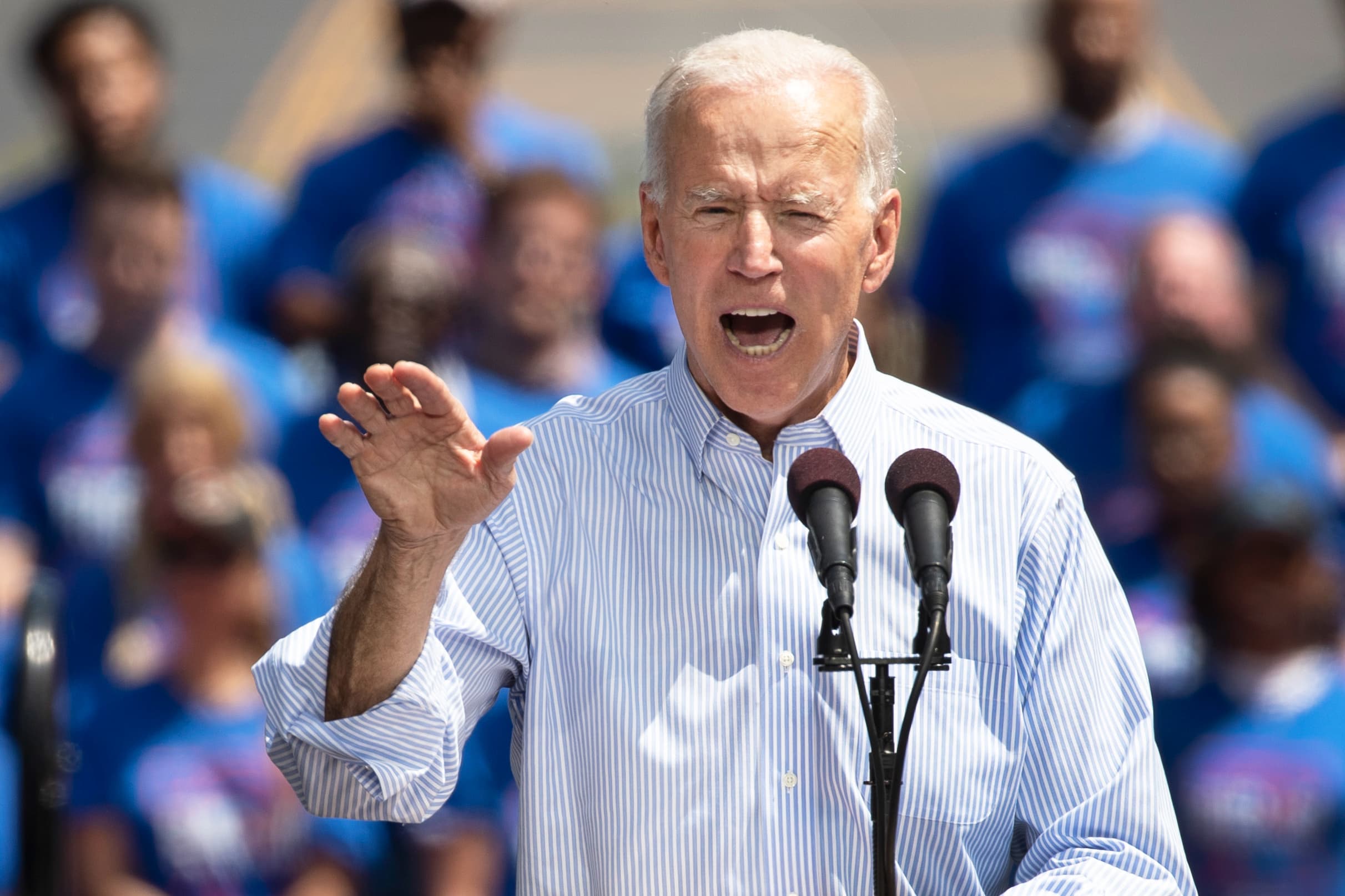

Former U.S. Vice President and Democratic presidential candidate Joe Biden speaks during a campaign kickoff rally, May 18, 2019 in Philadelphia, Pennsylvania.

Drew Angerer | Getty Images

WASHINGTON – Amazon and Joe Biden are in a Twitter spat, and it perfectly captures the controversy over America's new tax code.

The beef began when the frontrunner for the Democratic presidential nomination called out the online giant on Twitter.

"I have nothing against Amazon, but no company pulling in billions of dollars of profits should pay a lower tax rate than firefighters and teachers," Biden wrote Thursday morning. "We need to reward work, not just wealth."

Amazon fired back at the end of the day, redirecting the candidate's aim.

"We've paid $2.6B in corporate taxes since 2016. We pay every penny we owe. Congress designed tax laws to encourage companies to reinvest in the American economy," the company wrote on its Amazon News Twitter account. "We have. $200B in investments since 2011 & 300K US jobs. Assume VP Biden's complaint is w/ the tax code, not Amazon."

Biden's tweet linked to a New York Times story that cited data from the left-leaning Institute on Taxation and Economic Policy on companies that earned billions of dollars last year but paid no federal taxes. The analysis showed that Amazon topped the list, with pretax profits of nearly $11 billion. In fact, the group found the company actually enjoyed a negative tax rate of 1.2 percent, thanks to a $129 million income tax rebate.

This was not the result Republicans were going for when they drove the overhaul of the tax code through Congress two years ago with party-line votes in both chambers. The legislation, which President Donald Trump signed into law in late 2017, lowered the corporate tax rate from 35% to 21% and allowed companies to immediately expense their capital investments.

On the flip side, the new law offset some of the cost of those cuts by requiring companies to pay taxes on overseas earnings, a move intended to incentivize investing in America instead.

Republicans touted the tax cut as fuel for a new era of prolonged economic growth that would eventually cover the cost of not only the corporate rate cuts, but also steep reductions in individual tax rates.

That scenario has yet to materialize. GDP has surpassed projections by continuing to grow at a 3% rate. But it has come at a price: ballooning deficits and dwindling corporate tax revenue.

The Congressional Budget Office estimates the deficit to be $738 billion so far this fiscal year, up nearly 39% from the same period last year. Corporate tax receipts were down $11 billion, or nearly 9%.

"Well that's what happens when you cut the rate by 40%," said William Gale, co-director of the nonpartisan Urban-Brookings Tax Policy Center. "You would need heroic growth to make up the difference."

But the pace of decline has been taken even the experts by surprise. As recently as January, the CBO had projected that corporate tax revenue would rebound this year, as some of the immediate benefits of the new law wore off.

Instead, the opposite has occurred, and no one is really sure why.

"Corporate revenue has fallen off a cliff faster than I think anyone has anticipated," said Seth Hanlon, senior fellow at the Center for American Progress and a former adviser to President Barack Obama.

Perhaps it's because companies have not repatriated their overseas profits as quickly as forecast. Maybe tariffs are reducing corporate income and thereby lowering corporate tax receipts. (Side note: Revenue from customs duties are up more than 80 percent this year to nearly $45 billion.)

No matter the reason, the numbers add up to a giant headache for Republicans and a guarantee that cases like Amazon will remain political punching bags well into the 2020 election.

Correction: This story was updated to reflect correct deficit and corporate tax receipt data for the fiscal year.