Beating The Fade - Why Product Cycle Innovation Has Kept Microsoft On Top - 21 minutes read

Beating The Fade - Why Product Cycle Innovation Has Kept Microsoft On Top - Microsoft Corporation (NASDAQ:MSFT)

Beating The Fade - Why Product Cycle Innovation Has Kept Microsoft On Top - Microsoft Corporation (NASDAQ:MSFT)DISCLAIMER: This article is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this article is not an offer to sell or buy any securities. Nothing in it is intended to be investment advice and it should not be relied upon to make investment decisions. Cestrian Capital Research Inc or its employees or the author of this article or related persons may have a position in any investments mentioned in this article. Any opinions or probabilities expressed in this report are those of the author as of the article date of publication and are subject to change without notice.

This is the first in the new “Fundamentals of Software” series of articles from Cestrian Capital Research, Inc. We’re going to cover a series of expert topics that impact software companies and those that invest in them. We’ll be covering technology, finance, marketing, and sales topics in the next few months. We’ll focus on a specific single-stock thesis each time to illustrate the point, so that these notes are helpful to those considering that stock.

Our aim with this series is to help our readers understand the software market better, so that they can make better investment decisions as a result. The work is a result of our own reflections on 20+ years of investing in the software sector and our direct experience as a board member of software companies dealing with these topics.

This first article concentrates on product cycle innovation. Our stock-specific thesis here is that we believe Microsoft (MSFT) will continue to be a sound long-term investment - even if entering at the current close-to-all-time-high price level. We believe this because Microsoft, under new CEO Satya Nadella, has not only transcended its original computing paradigm but it has embraced three further new markets, and had the confidence to pay big for them in acquisitions. This is a difficult thing for large, incumbent companies to do – much easier to deny or downplay the future than to risk embarrassment by paying up for it. We believe this embrace of new, large markets is the most important action Microsoft has taken to drive share price growth since Nadella was appointed CEO in 2014, and for as long as this approach continues, we believe Microsoft can continue to be a strong long-term investment.

Turning now to the topic at hand:

“Product cycle innovation”. Sounds boring, right? It isn’t. It’s why Microsoft is a trillion-dollar company today and IBM (NYSE:IBM) isn’t; it’s why Microsoft just grew its quarter-on-prior-year quarter revenues by 25% and Oracle (NYSE:ORCL) didn’t.

The start date of the chart is 20 August 2011, the day that Netscape founder and VC Marc Andreesen published the now-famous “Software Is Eating The World” motto. You can read his blog post from that day here >> Why Software Is Eating the World. As everyone now knows, he was correct. So, if being in the business of software was such a wonderful place to be in 2011, why have Oracle and IBM underperformed the S&P 500 since then, but Microsoft soared above it?

The answer, we believe, lies in product cycle innovation.

Most software companies start with a single product in mind. The entrepreneur has usually identified an inefficiency in a consumer or enterprise process that could be automated – or further automated – with a particular software routine. To give some old and new examples, PayPal (PYPL) sought to simplify the online payments process for both buyers and sellers; Zscaler (ZS) seeks to improve enterprise security by protecting employee devices’ route to the Internet; SVMK (SVMK) seeks to more efficiently collect customer feedback. There are thousands more examples.

The early stages of success of a software company follow a fairly standard path. Win early users, gain a cult-like following through word of mouth, convince larger user groups and/or enterprise buyers to use the product, expand the user base, become the de facto standard for the point solution that they offer. This was documented expertly in Geoffrey Moore’s Crossing the Chasm in 1991 and, at the highest level of abstraction, little has changed since. For a best-in-class example, read up on the early years of CRM which itself became an enterprise powerhouse through a skunkworks type of sales approach.

Being a successful point solution can get you through several rounds of venture capital and a successful IPO – look at Zuora ((NYSE:ZUO) - manages subscriptions and billing) or Eventbrite ((NYSE:EB) - event marketing and booking). It can sometimes get you 10+ years as a successful public company. Ultimately, though, the software companies that keep growing as technology cycles evolve, user needs change, and competitors group up point solutions into suite offerings, are those which successfully manage their product cycles such that they can keep inventing or acquiring new products which they can then shepherd through the early users/cult-group formation/wider use adoption cycle.

The simple version of product development is just to add new products that are say a single standard deviation away from the original launch idea. CRM’s first product was a sales force automation tool. Not long behind came a support center automation tool. Taking MSFT’s productivity applications as another example, it launched Word in 1983, and Excel two years later. Each of these were major development efforts in their own right, but they are stepwise expansions from a point solution towards a suite – they aren’t true product cycle innovations. What we mean by a cycle innovation is – can the company transcend the current paradigm in some way. Because when a generation change hits the computing industry, few vendors continue to grow. They tend to fall by the wayside and be acquired cheaply for their installed base. When the same Geoffrey Moore defined the principle of ‘Crossing the Chasm’, he meant the chasm between a small group of early users, and the mainstream market. But a chasm of similar difficulty is encountered when a software company is facing a change in underlying technology platform, be it operating system, network architecture, or user device type. And many fall into this type of chasm – few cross it. Think of all the software names that proliferated in the mainframe era, and think how many are market leaders today – virtually none of them.

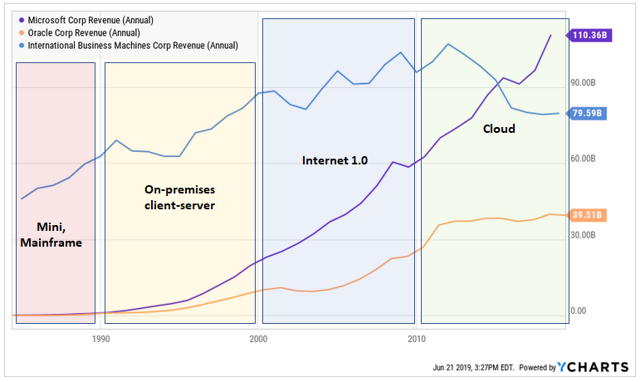

Below we chart the absolute annual revenue amounts for MSFT, IBM, and ORCL over the last 35 years or so. We’ve labelled each decade with the prevailing computing paradigm of the period. (The labels or exact time periods are intended to be indicative, not scientific – naturally, one could debate for days what such labels should be, or what the time periods should be). Broadly, we have the pre-1990 era as mini- and mainframe dominated – what we really mean is that the Wintel hegemony had not yet really taken hold; there were multiple Unix derived operating systems in the enterprise, multiple CPU chipsets requiring specific software architecture (x86, SPARC, etc.). From 1990 to 2000, the prevalence of Intel (NASDAQ:INTC) and Intel-clone (x86) CPUs on client and server-side increased, as did the usage of Windows operating systems – on the server side as well as client side, as Windows NT became more stable. 2000-10 we have called Internet 1.0 – the first internet boom when software companies offered the first version of applications delivered over the public Internet (a hard-to-scale model called an ‘application service provider’) before CRM taught the world about multi-tenant databases … which lead to the current highly scalable cloud era from about 2010 onwards.

Look at the revenue trends for these vendors as the paradigms shift.

We could show the same trend for a great many software companies – the vast majority don’t prosper into new paradigms when they open up.

Why is this? Well, lots of reasons, but at its core, we think it is to do with whether the CEO embraces the future paradigm and sets sail accordingly, or whether the CEO denies the new order and either avoids it or deals with it defensively. IBM and ORCL both adopted naysayer attitudes to cloud for quite a while before being forced to accept the new paradigm; MSFT embraced it much earlier on. (We don’t say there wasn’t a naysayer camp within MSFT; our point is that the CEO’s decisions didn’t go that way).

The Oracle Way, or, “Nothing To See Here, We Got This Cloud Thing Covered Already”

In 2008, ORCL’s Chairman and Founder Larry Ellison was quoted at a conference as saying,

What he probably meant was – accessing server data over the internet isn’t so different from accessing it over a private network, Oracle already has client-server architecture, what’s the new news – it must be just marketing-speak. In some ways, Ellison was right. But what ORCL didn’t see was the gradual transference of compute loads out of the enterprise and into the third-party datacenter, connected via a public network, processed and stored on low-cost stacks that didn’t include many – or sometimes any – Oracle-owned layers. In essence – ORCL got Schumpetered – the creative destruction (Creative destruction - Wikipedia) that capitalism wreaks upon its best was most certainly applied to ORCL by the new cloud generation. ORCL has since fought a rearguard action but having already declared cloud bunk, and been mostly unwilling to pay the very high revenue multiples attracted by cloud-first software companies, the company’s revenue growth has not kept pace with the market since cloud went mainstream.

The IBM Way, or, “If We Decide You’re Good Enough To Be A Customer, You Can Join Our Cloud Club”

IBM, always a less outspoken company than Oracle, failed to win a CIA cloud procurement contest in 2013 – losing to Amazon (NASDAQ:AMZN) – a bookseller! – on technical grounds despite offering a far lower price (you can read the detail here >> CIA spooks picked Amazon's 'superior' cloud over IBM). Think about that – Amazon beat IBM on technology six years ago – and IBM has never caught up. We think this reflects corporate belief going into the cloud era. IBM’s then VP of cloud, Ric Telford, said in 2011, “You can’t just take a credit card and swipe it and be on our cloud” – going against the exact model that had already seen huge success at CRM. (See IBM Faces a Crisis in the Cloud)

And, now, an example of how we believe it should be done.

The Microsoft Way or, “Let’s Not Mess Up Again Like We Did In Mobile and Internet 1.0”

In 2014, the former head of Microsoft’s Cloud and Enterprise Group, Satya Nadella, was appointed CEO. This led to the acceleration of a number of initiatives the company had already put in place to try to win in the new paradigm. In 2011, Microsoft had launched Office365, the subscription version of the Office productivity suite. The applications were and are still mainly downloaded rather than accessed solely over the internet. But Microsoft’s bravery was to risk cannibalizing its own on-premises perpetual licence revenue from traditional Office products. (In a future “Fundamentals of Software” note, we’ll cover subscription versus perpetual business models). In 2017, revenue from Office subscriptions eclipsed that from the Office perpetual licence. Similarly, the Azure computing and storage cloud platform was launched in 2010. It lagged Amazon’s AWS platform for a long time but began to gain share once Nadella became CEO.

Nadella has shown himself to be very embracing of new platforms. This contrasts clearly with Microsoft’s experience in the prior 25 years, when it failed to take Internet 1.0 seriously, ceding the market initially to Netscape on the client side and, on the server side, various Unix applications whose prevalence remains today – and then failed to take mobile seriously, ceding the market to Apple (NASDAQ:AAPL), Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and Samsung (OTC:SSNLF). Perhaps scarred by the experience – he worked at MSFT at the time of both errors – Nadella has spurred MSFT to spend big on cloud, mainly through internal product development. This impetus led to the growth of Azure and Office365. So far so good.

But what’s really impressive is that MSFT has looked beyond cloud to see what the next growth curves might be – and they’ve spent big on acquisitions to cover off those markets. Specifically, they have invested in gaming (Minecraft, a $2.5bn acquisition in 2014), social media (LinkedIn, a $26bn acquisition in 2016) and open source (GitHub, a $7.5bn acquisition in 2018).

Owning and driving cloud, followed by being prepared to spend big in three new categories of market, tells us that Nadella is also likely to embrace future tectonic shifts – and that bodes well for MSFT in our view.

MSFT stock is close to an all-time high, and it has advanced rapidly in the last three years – the chart above shows it breaking out from the S&P 500 performance in 2016 without looking back. It is hardly a secret that the company is on a roll, and Nadella is widely lauded as being responsible. So, surely, this is priced in, and the stock is topped out?

We don’t think so – at least not over the long term.

We can probably agree that the market is short-term stretched right now (this is the third time that the NASDAQ composite has hit 8,000, and the last two times have hit significant resistance around that level). So, all the stocks featured in this note probably have a better day to enter than right now, at least if you are looking for short-term gains. But in the long term, we believe Microsoft will continue to outpace its peers and outpace the market. For the most part, that is because of the reasons stated above i.e. the company has a core business which keeps growing and has given itself multiple shots on goal in new markets. But on top of that, the stock is undervalued relative to many of its peers once growth is taken into account. It's growing revenues at the twice as quickly as SAP, but its EV/TTM EBITDA valuation is 20% below that of SAP. And, whilst ORCL is going backwards, MSFT is valued at just 45% higher on an EV/EBITDA basis. The chart below tells the story – MSFT stock is significantly below the trendline. That looks like free money to us – and who doesn’t like free money?

Stepping back for a moment – our “Fundamentals of Software” series is all about taking specific topics, investigating them via single-stock analysis, and using what we learn to improve our long-term investing decisions.

We think the big takeaway from MSFT’s success in product cycle innovation is that if you intend to buy and hold a software stock over the long term – meaning 3-5 years plus – then it is wise to investigate their product and market expansion plan. Right now, there are a slew of point-solution cloud vendors riding high; we could point to tens of stocks but to pick just two, The Trade Desk (TTD) and Zscaler (ZS), these are companies reporting fast growth and substantial cashflow margins right now (ZS is operating cash flow positive but not accounting-profitable), with very large market opportunities in front of them. Their valuations are suitably meaty (TTD currently sits at an EV/TTM Revenue ratio of 21x and an EV/TTM EBITDA ratio of 89x; ZS at an EV/TTM Revenue ratio of 34x). As a short-term trade or a medium-term investment, there is likely still money to be made despite those valuations. Both stocks are volatile – they swoon by 5-10% with reasonable regularity only to bounce back thereafter, then continue their upward march driven by continued revenue and cash flow growth. All good for the swing trader or short-term investor.

Generally speaking, we believe that your investment horizon should determine the degree of importance to you of a company’s long-run product cycle innovation. If you plan to be in a stock for the next week or the next month, then as long as the company has a number of new products in the offing, single-standard-deviation type moves, then product cycle innovation is unlikely to harm or help your investment. Other factors will be far more determinative of your outcome. But if you want to buy and hold over a long period of time – say two-three years or more – then we believe you should look closely at a company’s attitude to long-run product cycles.

If a company is in denial about an emerging fundamental code platform, be careful. If a company believes the current user device paradigm will last for the foreseeable future, be careful. If a company believes its users are fundamentally sticky and it can keep increasing prices forever, be careful.

We would point to the famous maxim espoused by Andy Grove of Intel, “only the paranoid survive”. Software is famously cheap to develop, and getting cheaper. Coding is the new lingua franca. A lot of people speak it. Having been eating the world for a while now, cloud software will itself become prey whilst everyone is looking the other way. We don’t know what replaces cloud, but we know something will, and it will be winning share quietly and cheaply somewhere in the world already. So, if you want to invest in a company that has the chance to be as long-run-successful as Microsoft, look very closely at its product cycle innovation.

We’re an SEC-registered Investment Advisor. We operate a space-sector equity research service and publish extensively here on Seeking Alpha about companies in the space industry. (You can see our free articles here). We have a coverage universe of about 20 stocks in the space sector, and we don’t trade this coverage universe for our own account, in order to avoid actual or potential conflicts of interest with our readers and subscribers.

We do however own software stocks for our personal accounts and will disclose as such whenever we refer to those stocks in our “Fundamentals of Software” notes. With regard to the companies mentioned in this note – we are long MSFT, long Salesforce (CRM) and long The Trade Desk but hold no position in any other stock or index mentioned.

Disclosure: I am/we are long MSFT, CRM, TTD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Product lifecycle • Innovation • Microsoft • NASDAQ • Microsoft • Information technology • Security (finance) • Chester • Capital (economics) • Research • Corporation • Employment • Investment • Opinion • Report • Article (publishing) • Chester • Expert • The Fourth Dimension (company) • Technology • Finance • Marketing • Market (economics) • Board of directors • Product lifecycle • Innovation • Stock • Microsoft • Microsoft • Price level • Microsoft • Chief executive officer • Satya Nadella • Programming paradigm • Microsoft • Chief executive officer • Microsoft • Investment • Product lifecycle • Innovation • Microsoft • United States dollar • Company • IBM • New York Stock Exchange • IBM • Microsoft • Fiscal year • Fiscal year • Revenue • Oracle Corporation • New York Stock Exchange • Oracle Corporation • Netscape • Software • Blog • Software • Software • Oracle Corporation • IBM • S&P 500 Index • Microsoft • Product lifecycle • Innovation • Entrepreneurship • Consumer • Business • Business process • Automation • Software • PayPal • Measuring programming language popularity • Internet • Payment • Business process • Zscaler • Business • Computer security • Employment • Electronics • Internet • Customer service • User (computing) • Word of mouth • User (computing) • De facto standard • Geoffrey Moore • Moore's Crossing Historic District • Crossing the Chasm • Customer relationship management • Skunkworks project • Venture capital • Initial public offering • Zuora • New York Stock Exchange • Eventbrite • New York Stock Exchange • Public company • Technology • Evolution • Consumer • Competition • New product development • Standard deviation • Customer relationship management • Product (business) • Sales force management system • Tool • Microsoft • Microsoft Excel • Product lifecycle • Innovation • Company • Paradigm • Geoffrey Moore • Crossing the Chasm • Software industry • Technology • Operating system • Network architecture • User (computing) • Machine • Thought • Software • Mainframe computer • Microsoft • IBM • Oracle Corporation • Programming paradigm • Minicomputer • Mainframe computer • Wintel • Unix • Operating system • Enterprise software • Central processing unit • Chipset • Software architecture • X86 • SPARC • Intel • NASDAQ • Intel • Intel • Clone (computing) • X86 • Central processing unit • Server-side • Operating system • Server-side • Client (computing) • Windows NT • Debian • Dot-com bubble • Independent software vendor • Software versioning • Application software • Real-time computing • Application service provider • Customer relationship management • Multitenancy • Database • Scalability • Cloud computing • Revenue • Paradigm • Paradigm • Chief executive officer • Paradigm • Chief executive officer • New Order (band) • IBM • Oracle Corporation • Cloud computing • Paradigm • Microsoft • Microsoft • Oracle Corporation • Cloud computing • Oracle Corporation • Larry Ellison • Data • Internet • Private network • Oracle Corporation • Client–server model • NeWS • Corporate jargon • Larry Ellison • Oracle Corporation • Computing • Business • Data center • Computer network • Oracle Corporation • Oracle Corporation • Creative destruction • Creative destruction • Wikipedia • Capitalism • Oracle Corporation • Oracle Corporation • Cloud computing • Revenue • Cloud computing • Revenue • Economic growth • Market (economics) • Mainstream • IBM • Cloud Club • IBM • Oracle Corporation • Central Intelligence Agency • Procurement • Amazon.com • NASDAQ • Amazon.com • Technology • Price • Central Intelligence Agency • Espionage • Amazon.com • IBM • Amazon.com • IBM • IBM • IBM • Credit card • Customer relationship management • IBM • Microsoft • Internet • Microsoft • Satya Nadella • Chief executive officer • Programming paradigm • Microsoft • Office 365 • Subscription business model • DR-DOS • Productivity software • Application software • Internet • Microsoft • Software • Subscription business model • Business model • Revenue • Microsoft Office • Subscription business model • Microsoft Office • License • Microsoft Azure • Computer • Computer data storage • Cloud computing • Amazon.com • Amazon Web Services • Market share • Chief executive officer • Microsoft • Internet • Marketing • Netscape • Client-side • Server-side • Unix • Application software • Mobile phone • Marketing • Apple Inc. • NASDAQ • Google • NASDAQ • Alphabet Inc. • NASDAQ • Alexion Pharmaceuticals • Samsung • OTC Markets Group • Microsoft • Software bug • Microsoft • Cloud computing • New product development • Microsoft Azure • Office 365 • So Far So Good (Bryan Adams album) • Microsoft • Cloud computing • Mergers and acquisitions • Minecraft • Mergers and acquisitions • Social media • LinkedIn • Mergers and acquisitions • Open-source model • GitHub • Mergers and acquisitions • Cloud computing • Microsoft • Microsoft • S&P 500 Index • Stock • Financial market • Nasdaq Composite • Microsoft • Market (economics) • Market (economics) • Stock market • Economic growth • It's Growing • Revenue • SAP SE • The Third Manifesto • Valuation (finance) • SAP SE • Oracle Corporation • Microsoft • EV/EBITDA • Microsoft • Stock • Freigeld • Free Money (film) • Investment • Decision-making • Microsoft • Product lifecycle • Innovation • Buy and hold • Software • Stock • Market (economics) • Riding High (1950 film) • Stock • Tirumala Tirupati Devasthanams • Zscaler • Economic growth • Cash flow • Profit margin • Operating cash flow • Accounting • Profit (accounting) • Financial market • Valuation (finance) • Trinidad and Tobago dollar • Enterprise value • TTM (programming language) • Revenue • Enterprise value • TTM (programming language) • Earnings before interest, taxes, depreciation, and amortization • CIMX-FM • Siemens (unit) • Electronvolt • TTM (programming language) • Revenue • Term (time) • Trade • Term (time) • Investment • Money • Stock • Volatility (finance) • Revenue • Cash flow • Economic growth • Swing trading • Investor • Investment • Company • Product lifecycle • Innovation • Stock market • Company • Number • Product (business) • Standard deviation • Product lifecycle • Factor analysis • Determinative • Buy and hold • Consumer • Device paradigm • Maxim Integrated • Andrew Grove • Intel • Software • Lingua franca • Microsoft • Product lifecycle • Registered Investment Adviser • Space industry • Securities research • Service (economics) • Seeking Alpha • Corporation • Space industry • Insurance • Stock market • Space industry • Trade • Insurance • Conflict of interest • Stock • Stock • Software • Company • Microsoft • Salesforce.com • Customer relationship management • Trade • Stock • Corporation • Microsoft • Customer relationship management • Trinidad and Tobago dollar • Seeking Alpha • Company • Stock market •