How Viagra revolutionized the erectile dysfunction market - 3 minutes read

The erectile dysfunction market isn't as lucrative as it once was, but that hasn't mattered much to Pfizer.

The New York-based pharmaceutical giant is holding a strong share in the ED drug marketplace even as competition from generic drugmakers consumes sales of its once-blockbuster male libido treatment, Viagra.

The medication, originally developed with the intention of treating high blood pressure in adults, became a hit for males struggling in the bedroom and Pfizer when it was introduced to the U.S. market in 1998. In its first quarter, Viagra brought a total of $400 million in revenue for Pfizer and would later produce annual sales of about $1.8 billion.

An estimated 1 in 10 men are affected by erectile dysfunction, or ED, according to the Cleveland Clinic. Viagra was the first noninvasive treatment for male impotency and opened up a previously undiscussed dialogue between men and their doctors about sexual health.

Nearly 21 years later, sales of the brand-name drug have dropped. Pfizer lost exclusive rights to the drug in December 2017, bringing with it a flood of generic versions. U.S. sales of "the little blue pill" declined 73% year over year in 2018 from $789 million to $217 million, Pfizer said in its fourth-quarter earnings report, as generics entered the market.

A strategy

Despite generic competition from other drugmakers, Pfizer has been able to maintain a significant market share thanks, in part, to launching its own generic version of the blue, diamond-shaped pill.

In late 2017, Pfizer announced it would produce a generic version, called sildenafil, at half the cost of the brand name. The company also said at the time it would offer new discount programs and increase its copayment card discounts to make the brand version more accessible to patients.

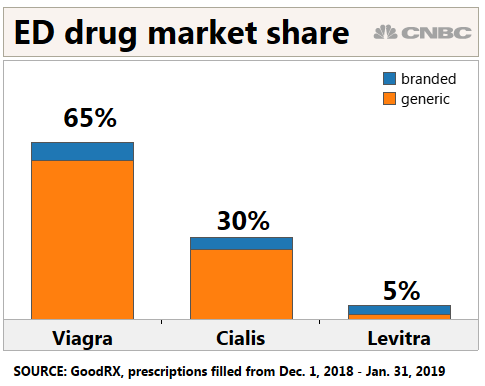

According to GoodRx, 65% of ED prescriptions filled from Dec. 1, 2018 to Jan. 31, 2019, were for Viagra or its generic version. Thirty percent of prescriptions were for rival Cialis and its generic, tadalafil. Levitra and generic vardenafil came in third at 5 percent of the market. A year prior, Viagra held only 51 percent of the market, with Cialis coming in at second at 45 percent.

Additionally, the gap between prescriptions filled for brand name versus generics is large. Ninety percent of the prescriptions filled over that same two-month time period were for Pfizer's generic version, while only 10% prescribed were for the brand name, according to GoodRx.

"The data can't explain the reason behind why people take the generic over the brand, or vice versa," said Tori Marsh, data and content manager at GoodRx. "But since generic Viagra is more affordable than the brand it's likely that cost is a factor here."

Marsh added most health insurers require that members be prescribed a generic when there is one available, and that pharmacies dispense the generic.

Taking it online

The rise of health tech start-ups, which allow patients to bypass their doctor and buy medication online, may also be keeping patients loyal to the brand-name drug.

For example, direct-to-consumer men's health brand Roman is removing middlemen such as drugstores and medical providers and allowing customers to buy ED meds online.

Pfizer also allows customers to buy Viagra from its website.

The proliferation of virtual platforms may be leading to an increase in purchasing medications online, said Dr. Anupam B. Jena, an economist and physician at Harvard Medical School. "It's interesting in that it dramatically reduces the stigma of buying a prescription."