Southwestern Energy Has A Liquids Option - 10 minutes read

Southwestern Energy Has A Liquids Option - Southwestern Energy Company (NYSE:SWN)

Southwestern Energy Has A Liquids Option - Southwestern Energy Company (NYSE:SWN)Southwestern Energy (SWN) sold some leases towards the end of fiscal year 2018 for more than $1.5 billion in net proceeds. Those proceeds enabled the company to pay down debt to the $2.3 billion reported in the fiscal first quarter. The cash balance increased to more than $300 million for a total liquidity of about $2 billion. More to the point, this gas producer has a liquids-rich future not yet recognized by the market.

Gas pricing has long been in a downward trend. More gas is coming online than the market needs. That fuels rumors of companies paying customers to take the gas. The reality is probably messy but also very different. The North American gas market has been marked by relative abundance ever since the unconventional oil business became a significant contributor to total United States production.

That relative abundance is unlikely to change anytime soon. However, the record low gas pricing is also generating increasing demand for that relatively cheap natural gas. The road to equilibrium is never smooth and predictable. However, it is clear that demand will grow. The key question is the proper strategy for gas producers to take until the gas market reaches a reasonable equilibrium.

Right now, the answer from the primarily gas production companies appears to be a shift towards liquids or sometimes just oil production. Southwestern Energy is no exception to this trend. In the meantime, the company has some of the lowest cost acreage in the dry gas part of Pennsylvania. That acreage may enable the company to make profitable gas sales at even lower than current pricing.

The company does have a location advantage in that it is closer to some premium Eastern Canadian markets than many producers (in addition to the extreme Northeast United States). Some of the residents in those areas pay sky-high pricing for natural gas in the winter. The company may be able to increase its presence in these premium markets to help with future profitability.

This company has a sum of bright potential future profitability opportunities that the market does not yet recognize. Instead, the market has focused on the currently weak gas pricing and the oncoming gas supplies from new gas plants and new midstream capacity. Mr. Market worries that future gas prices may drop significantly as a result.

Continuing technology improvements that lower the cost of wells, increase production, and in general lower total producer costs, aid gas producers as well as oil producers. The result is that break-even costs are a moving target.

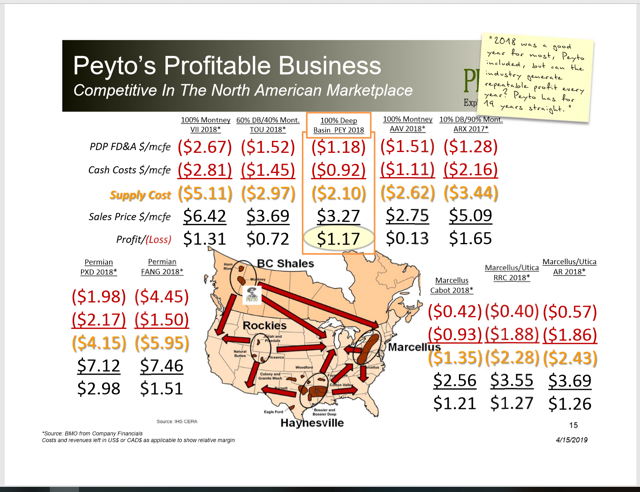

Probably the key is the relative strength of the American companies that are part of the Marcellus. Those margins are in American dollars. The primarily gas production margins reported by Cabot (COG), Range Resources (RRC) and Antero Resources (AR) compare favorably to the margin reported by Peyto (OTCPK:PEYUF) in Canadian dollars. Note that the Canadian dollar is worth about 25% less than the American dollar.

Southwestern Energy is located in some of the same favorable acreage as Antero Resources and the other Marcellus competitors. But Southwestern has an "ace up its sleeve" that some gas competitors do not have and that is Southwestern acreage that has liquids-rich production. That acreage could provide a lifeline to this primarily gas producer should gas prices continue to weaken.

The Southwestern Acreage is located primarily in West Virginia as shown below:

There is enough acreage there to substantially alter the production profile of the company in the future. If gas pricing remains weak enough, then the company can simply do what is necessary to maintain those dry gas leases while emphasizing the liquids-rich production.

Those liquids-rich leases appear to have a production mix similar to some of the Scoop and Stack leases. Depending upon continued drilling results, this company could grow cash flow significantly should production increases shift towards the Southwestern leases significantly.

Probably the least important liquid produced is ethane. That is produced in quantity when profitable. Ethane can be left in the gas stream when prices drop too low. The other liquids generally command a better price (especially the oil). That could change in the future because ethane can be used to make plastic. Plastic demand is growing and will probably continue to grow for the foreseeable future.

As the company high-grades its leases, investors can expect the maximum output of valuable liquids in the future. It does not take a lot of liquids to make a difference in the average pricing. Clearly, management has realized this profitability potential by growing liquids production rapidly.

Operating costs are rapidly dropping throughout the industry. This company is no exception to that trend.

In addition to the costs shown above, the company has a water handling system that appears to save about $500,000 per well. Water handling systems are rapidly replacing trucks as the preferred method to deliver and remove water associated with completion and production.

Many CEOs report that the end of these improvements does not yet appear to be on the horizon. As long as these cost reductions continue, then this company should be able to withstand lower gas pricing.

As shown above, the new wells being drilled in the Southwest have a materially different output profile from the company average. The decreasing costs should act to lower the payback period and rapidly increase company cash flow.

The key debt ratios improved materially with the sale of some leases in fiscal year 2018. Now, the new production emphasis should materially improve debt ratios in the future.

Management has a goal of long-term debt-to-EBITDA of 2.0. That may not be sufficient for the market. Often times during periods of relatively decent oil pricing the market demands a ratio of about 1.0. This management may find that their stock will appreciate more with relatively less debt. When Mr. Market perceives a company as a gas producer, he often does not allow as much debt leeway as he does for an oil producer. This appears to be due to the long downward long-term spiral of gas prices along with a perceived future downward price spiral.

Finances appear relatively adequate because the sale reduced the long-term debt-to-EBITDA ratio below 2. That decline continued in the first quarter. Oil pricing is a significant profitability boost. However, the company receives a significant discount for oil produced from the WTI standard.

Management has stated a goal to gain a free cash flow position by the next fiscal year. Clearly, the stock market has adopted a wait and see attitude to that forecast.

The significant sale was clearly seen as a non-recurring event. That is fair enough. But the ability of the Southwestern leases to significantly increase the company profitability is not in the picture.

The enterprise value of the company currently hovers below $4 billion. That value is about 3 times the cash flow from operating activities over the last twelve months. The sale last year may cause some negative production comparisons until management has replaced the production and cash flow sold.

However, the market clearly expects much worse to come in the future. Management will have to prove profitable growth in a basin not really known for liquids production at the current time. It therefore may take some time to convince the market of the potential profit possibilities some of the leases possess.

In the more immediate future, weaker gas pricing appears to be fully priced into the current stock price. Therefore, this stock may not have much downside risk. The upside potential in the future is clearly available for risk-tolerant investors. Gas producers are out of favor, so this stock may be worth the time to investigate the appreciation potential possibilities. Successful execution of a liquids-rich strategy could easily triple the stock price from current levels over the next five years.

Investors, however, should expect to wait for a market suitable track record through favorable quarterly reports before this stock begins to appreciate. A potential gas shortage could materialize at any time under the right weather circumstances. That shortage could cause a pricing spike that is worth trading on.

Disclosure: I am/we are long AR PEYUF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor and this is not a recommendation to buy or sell a security. Investors are recommended to read all of the company's filings and press releases as well as do their own research to determine if the company fits their own investment objectives and risk portfolios.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Southwestern Energy • Southwestern Energy • New York Stock Exchange • Southwestern Energy • Southwestern Energy • Southwestern Energy • Fiscal year • S15 (ZVV) • Debt • 1,000,000,000 • Fiscal year • Market liquidity • Market (economics) • Pricing • Bandwagon effect • Market (economics) • Customer • Gas • Unconventional oil • Petroleum industry • United States • Natural gas • Economic equilibrium • Supply and demand • Market (economics) • Economic equilibrium • Southwestern Energy • Pennsylvania • Company • Profit (economics) • Sales • Company • Canada • Northeastern United States • Sky High (2005 film) • Natural gas • Company • Market (economics) • Profit (accounting) • Company • Profit (economics) • Market (economics) • Factory • Midstream • Mr. Market • Gasoline and diesel usage and pricing • Technology • Cost • Oil well • Total S.A. • Cost • Natural gas • Petroleum • Break-even (economics) • Marcellus Formation • United States dollar • Natural gas • Gear • Range Resources • Canadian dollar • United States dollar • Southwestern Energy • Marcellus Formation • West Virginia • Manufacturing • Manufacturing • Oil well • Cash flow • Liquid • Ethane • Quantity • Profit (economics) • Ethane • Gas • Liquid • Planned economy • Price • Oil • Ethane • Plastic • Plastic • Supply and demand • Company • Investment • Gross domestic product • Management • Profit (accounting) • Industry • System • System • Manufacturing • Natural gas • Oil well • Gross domestic product • Company • Cost • Payback period • Cash flow • Debt • Sales • Lease • Fiscal year • Manufacturing • Debt • Management • Debt • Earnings before interest, taxes, depreciation, and amortization • Stock • Debt • Mr. Market • Company • Debt • Oil • Finance • Sales • Debt • Earnings before interest, taxes, depreciation, and amortization • Petroleum • Profit (accounting) • Company • Petroleum • West Texas Intermediate • Management • Free cash flow • Fiscal year • Stock market • Sales • Company • Profit (accounting) • Enterprise value • Company • Operating cash flow • Cash flow • Market (economics) • Market (economics) • Profit (economics) • Stock • Downside risk • Risk aversion • Stock • Investor • Market (economics) • Stock • Natural gas • Shortage • Time • Shortage • Trade • Corporation • Seeking Alpha • Corporation • Stock • Corporation • Financial adviser • Investor • Company • Press release • Research • Company • Risk • Portfolio (finance) •