Apple: Tariffs To Slide Right By - 6 minutes read

Apple: Tariffs To Slide Right By - Apple Inc. (NASDAQ:AAPL)

Apple: Tariffs To Slide Right By - Apple Inc. (NASDAQ:AAPL)The stock only trades at an EV of 11x forward EPS estimates once normalized for when the Chinese trade war ends.

While analysts are forecasting clear impacts from Chinese tariffs, Apple (AAPL) continues a return path to $200. Investors need to remember that the tech giant has already been hit by the Chinese trade war and the lapse of this impact will reinforce the bullish investment thesis heading towards year-end where the trade war offers mostly upside.

Apple has already been hit by the impacts to the Chinese economy and a reluctance of Chinese citizens to purchase and carry around iPhones in the face of the trade war. Additional 25% tariffs on Chinese goods imported into the U.S. such as iPhones and MacBooks would have an additional impact in raising costs of Apple's goods.

BofAML analyst Wamsi Mohan placed a $1 EPS hit on the tariff impact. The analyst suggests that each 1 million units of iPhones sold in the U.S. would impact profits by $0.02 per share. The U.S. only accounts for about 45% of sales, so the impact is minimized by Apple being a very global company.

Investors need to keep in mind that the September quarter is the second smallest quarter of the year, so the initial impact would be rather small. The real impact would be 25% tariffs that remain in effect for the holiday periods.

Apple has sold over 200 million iPhones for the last few years, so the annual impact could top the $1 estimate, if the U.S. actually topped 50 million units. The one caveat is whether Apple would be able to raise prices in such a scenario considering its premium smartphones already top $1,000 in some cases.

Sage Chandler, vice president of international trade for the Consumer Technology Association, predicted about a $70 impact to cellphones from the 25% tariffs. A phone costing $300 to assemble in China would have a $75 tariff.

The teardowns show iPhones costing anywhere from $370 when the iPhone X came out to a recent $430 for the iPhone XS Max. The possible impact to Apple is probably in the $75 to $100+ range considering older models have lower costs.

The impact on 1 million units with a real cost in the $100 million range comes up to a $0.02 impact predicted by Mr. Mohan. Apple has 4.6 billion shares outstanding, so the EPS impact appears slightly below the $0.02 range for 1 million units where the after-tax impact would be below $92 million.

The key is to not sweat the details. If Apple raised the prices on these iPhones to split the tariff impact with consumers, the EPS impact on 1 million units would only dip to a penny.

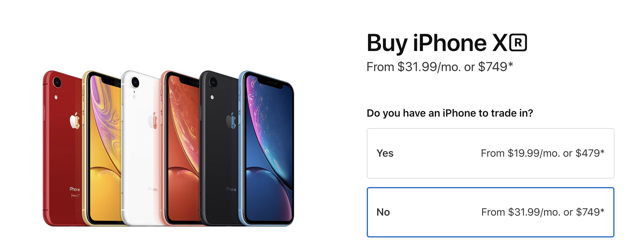

For consumers buying the XR for $749 or $31.99 a month, the additional cost in the $35 range is only equivalent to another monthly payment.

One can quickly see how consumers wouldn't bypass purchasing an iPhone just due to the higher costs of a 25% tariff due to the trade war.

The key to any investment story is the long term. How the Chinese trade war impacts Apple in FY21 is far more important than the current quarter.

Analysts have recently cut EPS estimates for those years and investors are clearly skeptical of these cuts. Investors should generally consider that the trade wars will be over by that time, not to mention that Apple would have lapsed the 2018 holiday impact from reduced China sales.

The average analyst had a FY21 EPS target in the $15 range prior to the Chinese weakness that hit the holiday quarter. The benefit is that Apple already took a big hit in the December quarter from lower Chinese demand. The potential positive on a trade deal is that this Chinese revenue will come back over time.

For FQ1'19, Apple saw Chinese revenue dip by an incredible $4.8 billion to only $13.2 billion. Without this impact, revenues were solid in most of the world.

So while the Chinese tariffs could hit annual EPS estimates in the $1 range and probably only around $0.50 as Apple is able to raise prices, the ultimate benefit occurs with the ending of the trade war. Apple will recapture the lost Chinese revenues and eliminate the EPS hit from the tariffs.

The key investor takeaway is that Apple has a quick path back to the $15 EPS target before all of the Chinese trade wars impacted forecasts. The company has about $24.50 per share in cash placing the stock at an EV of 11x those EPS estimates.

The tech giant will continue making large stock repurchases and boosting EPS estimates further when the trade war finally ends, making the current price at $195 a bargain. Either way, the tariffs will slide right by and investors will quickly forget them.

Disclosure: I am/we are long AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Apple Inc. • NASDAQ • Stock • Standard score • China • Trade war • Chinese Americans • Chinese Americans • Trade war • Market trend • Trade war • Apple Inc. • Economy of China • IPhone • Trade war • Tariff • China • Goods • Import • United States dollar • IPhone • Apple Inc. • Goods • Tariff • IPhone • United States dollar • Profit (accounting) • United States dollar • Apple Inc. • Multinational corporation • Investment • Fiscal year • Fiscal year • Apple Inc. • IPhone • Apple Inc. • Insurance • Smartphone • Vice President of the United States • International trade • Consumer Technology Association • S-300 missile system • China • Tariff • IBM System/370 • IPhone • Mercedes-Benz S-Class • IPhone • Apple Inc. • Apple Inc. • 1,000,000,000 • Shares outstanding • Tax • Apple Inc. • Price • IPhone • Tariff • Cost • IPhone • Cost • Tariff • Trade war • Investment • China • Trade war • Apple Inc. • Trade war • Apple Inc. • Nissan Silvia • China • Apple Inc. • China • Demand • China • Revenue • Apple Inc. • China • Revenue • Pulp (paper) • Revenue • China • Apple Inc. • Price • Trade war • Apple Inc. • Chinese Americans • Tariff • Investment • Apple Inc. • Frauenfeld–Wil railway • China • Trade war • Company • Stock • Money • Stock • Earnings per share • Stock • Earnings per share • Trade war • Price • Contract • Investment • Corporation • Seeking Alpha • Company • Stock • Corporation • Information • Solicitation • Security (finance) • Stock • Research • Financial adviser • Investment • Risk • Income statement • Bond (finance) •