Best Buy Is Not A Best Buy Anymore - 14 minutes read

Best Buy Is Not A Best Buy Anymore - Best Buy Co., Inc. (NYSE:BBY)

Best Buy Is Not A Best Buy Anymore - Best Buy Co., Inc. (NYSE:BBY)Best Buy is a great company that has stood the test of time and is currently doing well enough to negate the threat of online retailers.

Operating margins are likely to improve in the next 5 years supported by cost-saving initiatives implemented by the management and the integration of GreatCall results.

Best buys are what every investor is searching for in the stock market, but not everyone ends up finding and investing in best buys. Best Buy (NYSE:BBY) does not fit in my bucket of best buys in this market. BBY has declined 8% over the last 12 months, but being a growth investor, I still fail to find shares attractively priced. In fact, I expect income investors to find BBY attractively priced despite the concerns hanging over Best Buy’s ability to retain its profitability in the long term. The industry outlook is favorable, but not the increasing shift by consumers to purchase electronics online. Efforts by the management to reduce costs are yielding results, which would be a driver of profit margins in the future.

The global consumer electronics market is expected to reach $1,787 billion by 2024, representing a CAGR of 6% from 2018.

Best Buy operates in 3 markets: the U.S., Canada, and Mexico. The product range of Best Buy is expansive and includes all types and sizes of consumer electronics. The markets in which Best Buy is operating are expected to grow exponentially over the next several years, supported by the continued adoption of concepts such as the Internet of Things (IoT) and Smart Home.

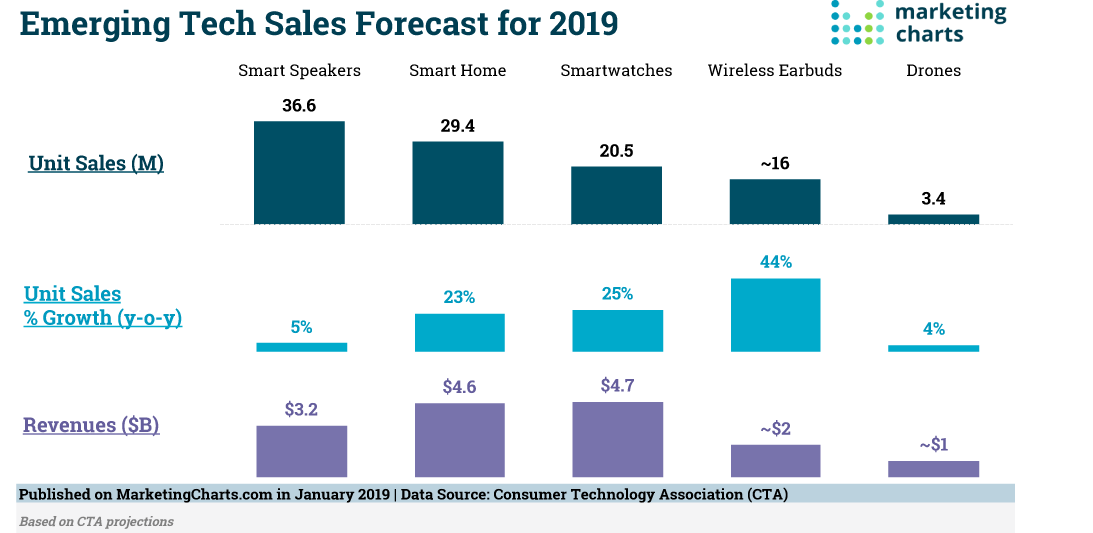

The U.S. represents the biggest market for Best Buy, which proves to be a tailwind for the continued growth of the company. The Smart Home-related consumer electronics industry is expected to grow 23% in 2019, which highlights the staggering growth that can be expected in innovative consumer electronics products sales.

Best Buy is in a good position to benefit from the increasing popularity of Smart Home concepts. The company has established a Smart Home department in all of its U.S. stores, which significantly improves the ability of Best Buy to penetrate into this growing business segment.

From its traditional store-based sales, Best Buy is increasingly diverting to a more online dominated sales channel. For the 3 months ended May 4, online sales accounted for 15% of total revenues, which is an improvement from the 13.5% contribution from online sales in the corresponding period last year. Best Buy is continuously improving the services offered online and plans to develop an option to enable potential buyers to chat with home improvement advisors online. The competition coming from established retail giants such as Amazon (NASDAQ:AMZN) will prove to be a concern for Best Buy’s growth prospects in the future, but at present, the company management is leveraging its long-term presence in the consumer electronics industry to generate increasing revenue from the online segment as well.

Best Buy is tapping into the billion-dollar healthcare industry as well, through GreatCall consumer devices and services. GreatCall offers health and safety products and services for senior citizens and has more than 900,000 paying subscribers.

Total Tech Support is another innovative subscription service that provides unlimited tech support to members. Considering the increasing and complicated number of electronics that are used by consumers to facilitate Smart Home features, this subscription-based tech support membership has the potential to gain traction and provide a steady stream of revenue to Best Buy. What distinguishes Total Tech Support from other similar services is that the subscription-based program provides tech support for electronics purchased from anywhere in the world, regardless of the brands or the vendor.

Improving operating efficiency is another focal point of the company management. During the first quarter of 2019, Best Buy achieved annualized cost reductions of $35 million, and the cumulative cost reductions since Q2 2018 stands at $575 million. Best Buy is well and truly on its way to achieving the cost reductions target of $600 million by 2021. Considering the pressure coming from online retail giants, it’s imperative for Best Buy to achieve operating efficiencies to keep profit margins intact.

Best Buy management is focused on achieving revenue growth, which is something that lacked during the last 5 years. The top line has barely grown over the last 5 years, which indicates the maturing nature of the company and the increasing pressure coming from online retailers. Despite flat revenue growth, earnings have increased at a steady rate supported by improving operating margins.

It’s a tad unrealistic to believe that Best Buy will receive a boost from its online presence to achieve revenue growth in the future at a significantly faster clip than what the company has achieved over the last 5 years, but cost efficiencies will certainly provide a boost to operating results of the company.

The favorable industry outlook will prove to be a good platform for Best Buy to earn stable revenues, but I do not consider the favorable industry outlook as a significant driver of revenue in the future.

Maintaining or improving operating profit margins will be the key to earn stable net income in the future. The trend has been positive in the last 5 years supported by reducing costs. GreatCall has higher profit margins, which is another driver of expanding operating margins. The products and services mix of Best Buy is important from this perspective to improve margins further in the coming years.

One other thing that should grab the attention of investors is how Best Buy is positioning itself to remain competitive in the future by investing in automating its warehouse facilities. In addition to this, Best Buy is focused on optimizing its stores to provide a better feel for potential buyers. Investments in technology will account for the bulk of investment dollars of the company in the next couple of years, and the company has rightly identified the importance of investing in improving the technical aspects of the business. Free cash flows will be negatively impacted by these capital investments but are necessary to secure earnings in the long term.

Computing and mobile devices category dominates the revenues earned by Best Buy, which highlights the importance of securing partnerships with mobile device manufacturers to use Best Buy in their distribution channels.

I do not see an imminent threat for Best Buy to lose these partnerships, but at the same time, it’s a work in progress. It would not come as a surprise if mobile device manufacturers and other electronic device manufacturers find ways to bypass retail stores including Best Buy to bring their products directly to end users. In the age of online shopping, the chances of such a phenomenon taking place are ever so increased. However, this would take time and I do not see this happening anytime within the next 5 years. Best Buy might have to use a pricing strategy to remain competitive in the future, which would be an adverse development in any case.

Overall, I expect Best Buy to earn flat revenues for the most part of the next 5 years, but to receive a boost to earnings through operating efficiencies. Continuing to penetrate the online retail market will be key for Best Buy’s success, but it would nearly be impossible to compete with established online retail giants without providing discounts to attract customers.

BBY is trading at a forward P/E of 12, which is in line with the historical average of 13.6. At this stage, I do not see a reason for BBY to trade well above the historical average earnings multiples as growth prospects are slim.

However, Best Buy is not trading at exuberant multiples as well, which has created a platform for income investors to invest in Best Buy shares at the current market price. As growth prospects diminish and capital expenditures decline, Best Buy would most likely allocate a higher portion of free cash flow to distribute as dividends. This makes BBY a good investment for income investors at the current price range.

Investors considering investing in Best Buy are mostly investors with a focus on income generation, rightly so. Best Buy has a decorated history of distributing wealth to its shareholders that date back to 2003. Dividend per share has grown consecutively through the last 5 years and shares yield 2.95% at the current market price.

One other thing that indicates the ability of Best Buy to continue distributing the current level of dividends to shareholders is the relatively stable dividend payout ratio of below 40%. Over the last 5 years, Best Buy has maintained an average payout ratio of 35%, and the current payout ratio is just below 34%. Attractive dividend yield coupled with a low dividend payout ratio is a sign of future dividend growth, especially considering the diminishing investment opportunities for the company.

Even though the current and historical payout ratios paint a positive outlook for continued dividend distribution, the all-important cash-generating ability of the company should also be incorporated into the dividend safety analysis.

As illustrated in the above chart, Best Buy has been covering its dividend distributions with free cash flow on a consistent basis, which is another positive sign for income investors. One other characteristic that is apparent from the above chart is that free cash flows have remained volatile over the last 5 years, which limits the ability of Best Buy to commit to distributing a higher cash dividend to investors.

I expect free cash flow to remain volatile in the near future as well, considering Best Buy’s continued efforts to optimize the cost structure and capitalize on ad spending. However, from an income investor’s perspective, there are no warning signs for dividend distributions. Dividend per share has grown 22% over the last 5 years, which might prove to be too good for Best Buy to beat in the next 5 years, considering the competitive nature of the industry the company operates in. However, it’s apparent that dividends will continue to grow.

While Best Buy has taken commendable measures to stay relevant amidst the hype of online shopping, the paradigm shift to online shopping of electronics will negatively affect the company in the long run as the company will have to fight it off against online giants such as Amazon. The playing field is not level anymore, and Best Buy would have to continue deviating from its comfort zone to secure earnings, which is not the ideal scenario for the company.

Investors need to pay attention to operating margins of the company as well since Best Buy would be forced to allocate a higher dollar amount on marketing and promotional efforts. This is essential for the company to stay neck to neck against online retail giants, which might prove to be a constraint on operating profit margins. At present, I believe Best Buy is doing its best to negate this impact by implementing other measures to reduce operating costs, but the question is how long the company can continue doing so.

Despite the clouds hanging over Best Buy, the company will retain its profitability through operating efficiencies. However, BBY is not the ideal investment for growth investors even though the company is operating in an attractive industry that is expected to grow at a steady rate for at least the next 5 years. With a yield of close to 3%, BBY provides an attractive investment opportunity for income investors.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Best Buy • New York Stock Exchange • Great Company (German) • GreatCall • Investment • Stock market • Best Buy • New York Stock Exchange • Market (economics) • Economic growth • Investor • Stock • Income • Best Buy • Profit (accounting) • Industry • Consumer • Electronics • Internet • Management • Futures contract • Multinational corporation • Consumer electronics • Market (economics) • United States dollar • 1,000,000,000 • Compound annual growth rate • Best Buy • Market (economics) • United States dollar • Canada • Mexico • Best Buy • Consumer electronics • Market (economics) • Best Buy • Exponential growth • Internet of things • Internet of things • Home automation • Market (economics) • Best Buy • Economic growth • Company • Home automation • Consumer electronics • Electronics • Economic growth • Innovation • Consumer electronics • Product (business) • Sales • Best Buy • Value (ethics) • Home automation • Concept • Company • Home automation • Retail • Best Buy • Business • Market segmentation • Retail • Best Buy • Distribution (business) • Best Buy • Service (economics) • Option (finance) • Home improvement • Internet • Competition law • Retail • Amazon.com • NASDAQ • Amazon.com • Best Buy • Consumer electronics • Electronics industry • Revenue • Best Buy • United States dollar • Healthcare industry • GreatCall • Consumer • Medical device • Service (economics) • GreatCall • Product (business) • Service (economics) • Technical support • Subscription business model • Technical support • Consumer electronics • Home automation • Subscription business model • Technical support • Streaming media • Revenue • Best Buy • Technical support • Service (economics) • Subscription business model • Software • Technical support • Electronics • Brand • Vendor • Best Buy • Best Buy • Best Buy • Best Buy • Management • Revenue • Economic growth • Company • Revenue • Economic growth • Income • Interest rate • Best Buy • Revenue • Economic growth • Company • Product (business) • Best Buy • Revenue • Revenue • Earnings before interest and taxes • Net income • Cost • GreatCall • Service (economics) • Best Buy • Best Buy • Automation • Best Buy • Mathematical optimization • Retail • Investment • Technology • Investment • Company • Company • Technology • Business • Cash flow • Investment • Security • Income • Long-Term Capital Management • Computer • Revenue • Best Buy • Mobile device • Best Buy • Best Buy • Mobile device • Electronics • Retail • Best Buy • Product (business) • Online shopping • Best Buy • Pricing strategies • Best Buy • Revenue • Online shopping • Retail • Best Buy • Price–earnings ratio • Best Buy • Income • Investor • Best Buy • Share (finance) • Market price • Economic growth • Best Buy • Free cash flow • Dividend • Goods • Investment • Income • Investor • Price • Investor • Best Buy • Investment • Income • Best Buy • Shareholder • Dividend • Share (finance) • Share (finance) • Market price • Best Buy • Dividend payout ratio • Best Buy • Dividend yield • Dividend payout ratio • Economic growth • Investment • Company • Dividend • Distribution (business) • Money • Company • Dividend • Best Buy • Dividend • Free cash flow • Cash flow • Volatility (finance) • Best Buy • Dividend • Investor • Free cash flow • Volatility (finance) • Best Buy • Advertising • Income • Investor • Dividend • Dividend • Best Buy • Industry • Company • Best Buy • Hype cycle • Online shopping • Paradigm shift • Online shopping • Electronics • Amazon.com • Best Buy • Company • Investor • Company • Best Buy • Marketing • Promotion (marketing) • Company • Online shopping • Regulation • Profit (accounting) • Best Buy • Best Buy • Company • Profit (accounting) • Economic efficiency • Investment • Economic growth • Investment • Company • Industry • Interest rate • Yield (finance) • Investment • Opportunity cost • Investment • Corporation • Stock • Seeking Alpha • Stock •