Nuclear fusion tech developer General Fusion now has Shopify and Amazon founders backing it - 4 minutes read

In a brief announcement today, the Canadian nuclear fusion technology developer General Fusion announced that the investment firm created by Shopify founder Tobias Lütke has joined the company’s cap table.

The size of the investment made by Lütke’s Thistledown Capital was not disclosed, but with the addition, General Fusion has the founders of the two biggest e-commerce companies in the Western world on its cap table.

Jeff Bezos, the founder and chief executive of Amazon, first invested in the company nearly a decade ago and General Fusion has been steadily raising cash since that time. In 2019, the company hauled in $100 million. That capital commitment is part of a haul totaling at least, $192 million, according to Crunchbase although the real figure is likely higher.

Indeed, General Fusion kept adding cash throughout 2020 as it looked to develop its demonstration fusion reactor.

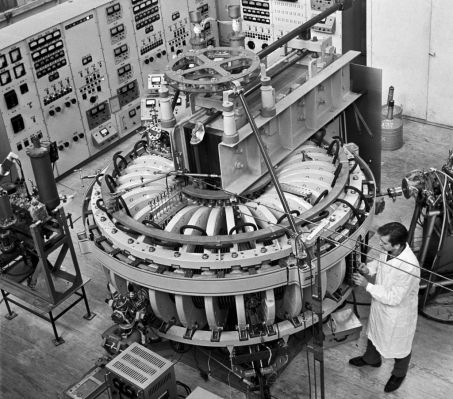

General Fusion’s process is based on technology called magnetized target fusion (MTF), first proposed by the U.S. Naval Research Lab and developed in the 1970s.

The process involves creating a magnetically confined moderately warm plasma of around 100 eV (roughly 50 times the photon energy of visible light) in a flux conserver (a shell that preserves the magnetic field). By rapidly compressing the flux conserver and the magnetic field inside of it surrounding the plasma, the plasma is superheated to a temperature that can initiate a fast fusion burn and create a fusion reaction, according to a 2017 description of the technology from General Fusion’s chief science officer and founder, Michel Laberge.

The company uses a roughly three-meter sphere filled with molten lead-lithium that’s pumped to form a cavity. A pulse of magnetically confined plasma fuel is then injected into the cavity. Then, around the sphere, pistons create a pressure wave into the middle of the sphere, compressing the plasma to fusion conditions.

Neutrons escaping from the fusion reaction are captured in the liquid metal, and the heat from that metal generates electricity via a steam turbine. A heat exchanger steam turbine produces the power and the steam is recycled to run the pistons.

In recent years, both General Fusion and its main North American competitor Commonwealth Fusion Systems have made strides in getting their small-scale nuclear fusion technology ready for commercialization.

In the past, the wry joke about fusion technologies was that they were always 10 years away, but now companies are looking at a four-year horizon to bring fusion to initial markets, if not the masses.

For its part, Commonwealth Fusion Systems is in the process of building a 10-ton magnet that has the magnetic force equivalent to 20 MRI machines. “After we get the magnet to work, we’ll be building a machine that will generate more power than it takes to run. We see that as the Kitty Hawk moment [for fusion],” said Bob Mumgaard, the chief executive of Commonwealth Fusion in an interview last year.

Other startup companies are also racing to bring technologies to market and hit the 2025 timeline like the United Kingdom’s Tokamak Energy.

Like General Fusion, Commonwealth also has deep-pocketed backers including the Bill Gates-backed sustainable-technology-focused investor, Breakthrough Energy Ventures. In all, those investors have committed over $200 million to the company, which formally launched in 2018.

As these companies begin readying their technologies for market, governments are laying the groundwork to make it easier for them to commercialize.

At the end of last year, the Trump administration signed the COVID relief and omnibus appropriations bill that included an amendment to support the development of fusion energy in the U.S.

The new amendment directed the Department of Energy to carry out a fusion energy sciences research and development program; authorized DOE programs in inertial fusion energy and alternative concepts to find new ways forward for fusion power; reauthorized the INFUSE program to create public-private partnerships between national labs and fusion developers; and created a milestone-based development program to support companies not just through RD, but into the construction of full-scale systems.

It’s this milestone program that was a cornerstone of the policy work that the Fusion Industry Association wanted to see in the U.S., according to a December statement from the organization.

By unlocking $325 million in financing over a five-year period, the U.S. government will actually double its research with matching contributions from the fusion industry. These demonstration facilities could go a long way toward accelerating the deployment of fusion technologies.

Founded in 2019, Thistledown Capital was formed to invest in tech that can decarbonize industry. The firm, based in Ottawa, has already backed CarbonCure, a technology that captures carbon dioxide from the air.

“General Fusion has a strong record of attracting funding support from some of the world’s most influential technology leaders,” said Greg Twinney, CFO, General Fusion, in a statement. “Fusion is planet-saving technology, and we are proud to support the mission of Thistledown Capital in its pursuit for a greener tomorrow.”

Source: TechCrunch

Powered by NewsAPI.org