Micron: Capex Guidance Will Be Critical To Semiconductor Equipment Suppliers - 5 minutes read

Micron: Capex Guidance Will Be Critical To Semiconductor Equipment Suppliers - Micron Technology, Inc. (NASDAQ:MU)

Micron: Capex Guidance Will Be Critical To Semiconductor Equipment Suppliers - Micron Technology, Inc. (NASDAQ:MU)Capital expenditures (capex) from memory chip companies are expected to be down 29% in 2019.

Semiconductor equipment revenues are directly correlated with historical memory revenues and thus capex, representing 21% of memory revenues.

Micron's capex disclosure during its upcoming earnings call will present a clear picture of equipment and memory revenues.

Micron Technology (MU) will announce its FY 3Q 2019 earnings report after market close on March 25. Capital expenditure (capex) guidance will be important for semiconductor equipment suppliers, because memory represented $53.9 billion of the total capex spend of the $103.2 billion in 2018. This article presents historical and future data on capex and semiconductor equipment revenues.

Capital expenditure includes equipment and fab construction costs. Table 1 shows capex spend by the top semiconductor suppliers between 2017 and 2020, according to our report entitled, “Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, CMOS Image Sensors, and Memory Chips.”

I’ve shown memory companies in Bold Italics, but note that Samsung’s revenues are for memory only (I’ve excluded other semiconductors and display), while Intel’s capex are for its total semiconductor business.

To date, the memory companies listed in Table 1 are expected to have a composite decrease of 23.9% in 2019. This compares to capex change. This compares to increases of 13.5% YoY in 2017, 50.0% in 2017, and $18.2% in 2018, as shown in Table 2.

The YoY increase in memory capex resulted in sequential increases in its percentage of the overall semiconductor industry capex spend, increasing from 39.3% in 2015 to 52.2% in 2018.

Table 3 shows memory capex spend vs. memory revenue. Of interest is that in the past four years, memory companies have been consistent in capex spend based on revenues – 33.1% to $36.4.

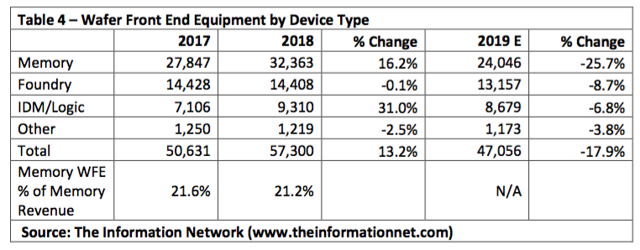

Table 4 shows WFE (wafer front end) equipment revenues (note this is equipment revenue only, not total capex) by device type for 2017 to 2019. Using memory revenue in Table 3 and Memory WFE equipment spend in Table 4, one can calculate that WFE represents 21% of memory revenue.

According to our report entitled, “Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts,” revenues grew 13.2% in 2018 but are projected to decrease 17.9% in 2019. Memory, which grew 16.2% YoY in 2018, is forecast to decrease 25.7% in 2019.

Clearly from these above charts, there is a correlation between memory revenues and memory capex spend. Micron already noted publicly that capex spend will be $9 billion, down only 0.5% from 2018, significantly less than the composite capex spend decrease of 23.9%.

However, my sources tell me it could be as low as $5.8 billion, which I discussed in a March 27 Seeking Alpha article entitled, “Semiconductor Equipment Revenues To Drop 17% In 2019 On 29% Capex Spend Cuts.”

Micron’s earnings report is critical to equipment manufacturers such as Applied Materials (AMAT) and Lam Research (LRCX). Capex spend (equipment and building) represents about 35% of memory revenues (Table 3) and equipment revenues represent 21% of memory revenues (Table 4).

Thus, an astute investor can get a handle on memory revenues based on memory capex (in a future Seeking Alpha article, I will calculate capex spend vs. memory revenue for each memory company). Also, since semiconductor equipment revenues are directly correlated with memory revenues, an astute investor can make a call on impact of equipment stocks on MU capex guidance.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Capital expenditure • Semiconductor • Military technology • Supply chain • Micron Technology • NASDAQ • Micron Technology • Capital expenditure • Capital expenditure • Integrated circuit • Company • Semiconductor • Machine • Revenue • Revenue • Capital expenditure • Revenue • Micron Technology • Capital expenditure • Corporation • Earnings call • Machine • Revenue • Micron Technology • Micron Technology • Fiscal year • Income • Capital expenditure • Capital expenditure • Semiconductor • Military technology • Capital expenditure • Data • Capital expenditure • Semiconductor • Machine • Revenue • Capital expenditure • Machine • Construction • Cost • Capital expenditure • Semiconductor • Supply chain • Temperature • Integrated circuit • Market analysis • Artificial intelligence • Artificial intelligence • CMOS • Image sensor • Computer memory • Samsung • Revenue • Computer memory • Semiconductor • Intel • Capital expenditure • Semiconductor • Capital expenditure • Capital expenditure • Capital expenditure • Capital expenditure • Revenue • Capital expenditure • Revenue • Wafer (electronics) • Military technology • Revenue • Military technology • Revenue • Capital expenditure • Machine • Revenue • Military technology • Revenue • Globalization • Semiconductor • Military technology • Market (economics) • Market (economics) • Stock • Market (economics) • Revenue • Correlation and dependence • Capital expenditure • Micrometre • Capital expenditure • Capital expenditure • Seeking Alpha • Semiconductor • Capital expenditure • Micron Technology • Military technology • Manufacturing • Applied Materials • Applied Materials • Lam Research • Capital expenditure • Military technology • Construction • Computer data storage • Revenue • Machine • Revenue • Revenue • Investor • Revenue • Capital expenditure • Seeking Alpha • Capital expenditure • Revenue • Semiconductor • Revenue • Correlation and dependence • Revenue • Investor • Stock • Capital expenditure • Corporation • Stock • Seeking Alpha • Corporation • Stock market •