AVEO Oncology: What You Need To Know Before August - 7 minutes read

AVEO Oncology: What You Need To Know Before August - AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO)

AVEO Oncology: What You Need To Know Before August - AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO)AVEO Oncology (AVEO) investors have been promised with new trial readout in August this year. However, while the company has failed multiple times to get approval for tivozanib, other competitors have emerged and brought in new therapy methods for renal cell carcinoma (RCC). Besides that, there are multiple issues related to the approval of tivozanib, which makes this company an unattractive buy.

Tivozanib is the highest developed drug and the only marketed drug of AVEO. It was approved by the EMA in August 2017, but the company has a problem to get approval from the FDA. In February 2019, the stock price plunged over 60% after announcing the delay of its submitted new drug application (NDA) for tivozanib. The main reason was the preliminary overall survival (“OS”) data. While tivozanib has managed to prove its efficacy in median progression-free survival vs. sorafenib in the Tivo-1 and Tivo-3 study, the Tivo-1 data has also revealed that the overall survival rate was lower for tivozanib vs. sorafenib. Not only the FDA has expressed these concerns, but the EMA might also change their opinion about their recent approval of tivozanib after the readout in august this year. So far, the preliminary TIVO-3 OS result has revealed a 12% higher rate of death for tivozanib than the control population. Furthermore, Merck (MRK) and Pfizer (PFE) have brought two new combination therapy for RCC, which clearly beats tivozanib and the existing standard of care. With the preliminary negative OS readout and multiple red flags, which will be discussed later in the article, AVEO will face serious threats in the future and it is unclear whether the company can overcome this.

What is the median progression-free survival?

Unfortunately, renal cell carcinoma is a serious disease without a cure, most of the drugs can only extend the patient lifetime. Progression-free survival is thereby defined as the length of time during and after the treatment, that a patient can live with the disease without worsening.

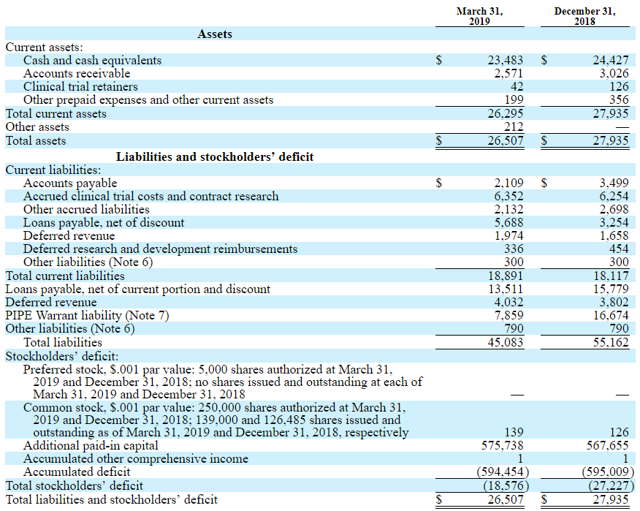

On the balance sheet, the total current asset is $26.3M. The company average cash burn is around $7-8M per quarter. The revenue in March 2019 was $1.6M and very little compared to the company's costs. The company has no significant cash reserve and has issued stocks in April 2019 to finance its operation. Interestingly, right before this event, the stock price surged after rumors about a possible acquisition from AstraZeneca emerged. The financial situation of the company is difficult. Without positive OS read out in August, the company might lose the EMA marketing rights for tivozanib and therefore their only significant revenue source.

Renal cell cancer is, unfortunately, a common and deadly type of cancer. The highest incidences are in the US with 64,000 new cases of RCC and 14,000 RCC-related deaths each year. Developing a drug for such a problematic disease is definitely very promising. AVEO Oncology is by far not the only company, which try to enter this market. Furthermore, insufficient trial data in the Tivo-1 study from 2013 revealed tivozanib's disadvantage OS data vs. sorafenib. One spokesman of the company claimed that many patients from the sorafenib arm switched to the tivozanib arm, while more tivozanib patients stayed on this drug. This leads to an imbalance results of OS outcome. Unfortunately, the newer Tivo-3 trial showed the same trend of increasing risk of death. Many similarities are hard to overlook if we compare the events from 2013 with today's situation. First, the company ran into the problematic OS data in the Tivo-1 trial, claiming this was due to poor study design. Then, something strange happened. Back then, the FDA demanded another trial from the company. But in the earnings conference call and multiple investor conferences after this meeting, the company failed to communicate this issue to their stockholders. Even more intriguing is the fact that the company raised $53.8M in a secondary offering in January 2013. Not until April 30, 2013, in advance of the adcom for tivozanib, the company finally releases this information leading to a sellout of the stock. In the end, this led to a $4M settlement with the SEC and the resign of AVEO's former CEO and several other high officials. In the mentioned adcom, the drug was then voted down by 13:1.

From our perspective, we think, that the clinical outcome will not matter for AVEO at this point. In this year, two new combination therapies from Merck and Pfizer have been approved and their clinical data are impressive.

In summary, the new therapies show clearly supreme benefits vs. tivozanib, sorafenib, and sunitinib, which is the standard of care for RCC at the moment. Furthermore, the data from tivozanib and sunitinib (1 line treatment PFS of 11.9 months and 11.1 months, respectively) have similar benefits for patients. It is therefore unclear whether tivozanib is superior vs. the standard therapy, which is the main reason for the approval.

Nevertheless, there is little hope for AVEO. Last year, the company teamed up with AstraZeneca (NYSE:AZN) (OTCPK:AZNCF) to develop a new combination therapy. AstraZeneca's Imfinzi (durvalumab) will be tested together with AVEO's Fotivda (tivozanib) to develop a new therapy for non-small-cell lung carcinoma (NSCLC). But the Phase I trial is expected to start in 2019, so it would take a very long time until the drug can generate any significant revenue for AVEO.

AVEO pharmaceutical has an unfavorable past with the approval of tivozanib in 2013. Six years later, very similar problems from the newer Tivo-3 trial have emerged bringing the company in a difficult financial situation. Meanwhile, Pfizer and Merck have developed newer combination therapies, which put an older active ingredient in the shade. Even if the readout in August is good, it is unclear whether it can help the company significantly.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Oncology • Pharmaceutical industry • NASDAQ • Oncology • Tivozanib • Renal cell carcinoma • Renal cell carcinoma • Tivozanib • Tivozanib • Drug development • Drug • European Medicines Agency • Food and Drug Administration • New drug application • New drug application • Tivozanib • Survival rate • Tivozanib • Efficacy • Median • Progression-free survival • Sorafenib • TiVo • TiVo • Clinical trial • TiVo • Survival rate • Tivozanib • Sorafenib • Food and Drug Administration • European Medicines Agency • Tivozanib • TiVo • Mortality rate • Tivozanib • Merck & Co. • M. R. Krishnamurthy • Pfizer • Pacific Fruit Express • Combination therapy • Renal cell carcinoma • Tivozanib • Progression-free survival • Renal cell carcinoma • Disease • Cure • Pharmaceutical drug • Patient • Progression-free survival • Therapy • Balance sheet • Current asset • 3M • Cash • Fiscal year • Revenue • Company • Company • Stock • Business operations • Competition • Stock • Takeover • AstraZeneca • Finance • Company • European Medicines Agency • Marketing • Intellectual property • Tivozanib • Renal cell carcinoma • Incidence (epidemiology) • Renal cell carcinoma • Renal cell carcinoma • Drug • Disease • Oncology • Clinical trial • TiVo • Tivozanib • Sorafenib • Sorafenib • Tivozanib • Tivozanib • TiVo • Clinical trial • TiVo • Food and Drug Administration • Investor • Company • Shareholder • Company • Secondary market offering • Tivozanib • S4M • U.S. Securities and Exchange Commission • Chief executive officer • Merck & Co. • Pfizer • Clinical trial • Tivozanib • Sorafenib • Sunitinib • Renal cell carcinoma • Tivozanib • Sunitinib • Therapy • Progression-free survival • Tivozanib • Therapy • AstraZeneca • New York Stock Exchange • Azerbaijani manat • Combination therapy • AstraZeneca • Durvalumab • Tivozanib • Non-small-cell lung carcinoma • Non-small-cell lung carcinoma • Phases of clinical research • Pharmaceutical drug • Pharmaceutical drug • Tivozanib • TiVo • Clinical trial • Pfizer • Merck & Co. • Active ingredient • Seeking Alpha • Microcap stock •