What Gen Z Thinks About Bitcoin - 19 minutes read

What Gen Z Thinks About Bitcoin

What Gen Z Thinks About BitcoinOver the last few months, the 2019 interns of Manole Capital conducted a financial services survey, specifically targeting the thoughts of America's younger generations. Specifically, we sought out Gen Z (those born after 1996) and Millennials (born 1981 to 1996).

We feel it is important to understand the perspective of these younger individuals, especially since Gen Z now represents nearly 20% of the US population. This year, Gen Z will reach 61 million individuals and become the US's largest generation. This younger generation was born after the internet went mainstream and the oldest amongst them was only 10 years old when the iPhone was introduced by Steve Jobs. Most of Gen Z is still in school, but they have direct spending power of over $140 billion annually. Early analysis shows that Gen Z consumers are less concerned about brands, labels or even corporate names. They are quite entrepreneurial, ethnically diverse, socially tolerant and environmentally aware.

Manole Capital exclusively focuses on the emerging Fintech industry. The goal of these research notes is to provide valuable insights, specifically in the financial services segment, into this growing category of younger individuals. In total, we were able to survey 195 individuals. Respondents were asked a series of questions on four financial subjects, which will be released in four distinct notes:

The questions we asked, as well as the information we received, are summarized below. Where possible, we have attempted to provide our conclusions and opinions. While some may be viewed as controversial, it is simply intended to serve as possible Gen Z and Millennial perceptions. This is the second annual financial services survey performed by the interns of Manole Capital. Where we feel it is interesting to note, we will comment on large discrepancies and changes from last year's survey.

How Millennials and Gen Z make purchasing decisions and what they look for in a brand is shifting. However, we believe that personalization has become increasingly important in today's society. This requires a different set of tools. The scope of reinvention requires analysis and we hope this research provides some valuable insights.

Out of the 195 individuals that participated in our online survey, 89% were between the ages of 12 and 23 (Gen Z), while 9% were aged 24-28 (Millennials) and 4% of respondents were older than 39 (Gen X or Baby Boomer).While we would have preferred the sample size exceeding 500, we are pleased to have 98% of those questioned under 38 years old. For the few Gen Xs and Baby Boomers that participated, we appreciated your participation, but you ruined our age demographic. Way to go Mom & Dad!

Geographically, 96% of the sample lives in the United States, while the other 4% are from South America, the Middle East, Africa, and Europe. Since we attend the University of Tampa, a high percentage of our survey is based in Florida.

Our firm's definition of FINTECH is "anything utilizing technology to improve an established process or procedure". While many think of FINTECH as just digital currencies or bitcoin, our scope covers much more of the landscape. For example, we believe that the quintessential FINTECH business involves the emerging payments business.

Even though the concept of digital currencies dates to the early '80s, digital currencies became a proof of concept in 1990 when David Chaum introduced DigiCash. Nevertheless, this concept and others like it (Bitgold & B-money) were premature and not fully developed. However, everything changed when Bitcoin was introduced in January 2009 with blockchain technology to supplement the ledger process. One of the underlying benefits of the digital currencies such as Bitcoin is that it eliminates third parties and is fixated on the sender and the receiver.

The more impressive notion is the technology that supports the transaction process, which is known as "blockchain." Blockchain is public ledger that has a record of every transaction that has ever occurred on the Bitcoin peer-to-peer network and been verified by a process called "mining." The authenticity of the exchange of digital currency is managed through the use of cryptography, which is an advanced encryption technique.

Blockchain technology is used to record digital transactions between two parties. In order to validify each transaction and that there are no fraudulent activities taking place such as double spending, "miners" use a cryptographic hash function called "SHA256". After the transaction is confirmed, it is then permanently added to the blockchain ledger. It could take about 10 minutes or more to transfer bitcoin to a wallet depending on any fees attached.

Other digital currencies that transfer quicker than Bitcoin are Ripple with 1,500 transactions per second, Litecoin with 56 transactions per second, Ethereum at 20 transactions per second and Dash at 48 transactions per second. For perspective, Visa (NYSE:V) can handle 65,000 card transactions per second.

To start this section of our survey, we asked our respondents if they own cryptocurrencies or not. With cryptocurrencies being relatively new to market and unregulated, we were not too surprised to learn that only 17% of our sample own digital currencies.

However, only 12% of respondents from our inaugural survey reported owning cryptocurrencies. Progress is being made, regardless of the drastic deprecation of most major digital currencies in 2018.

In order to be considered a currency, it must satisfy two conditions. First, it needs to be a mechanism or vehicle to transact. Can the asset be a "medium of exchange"? Can you walk into a store and leave with a good or service by exchanging this currency? While this is improving ever so slowly, most digital currencies fail this question. It will likely be quite a while before we can purchase a beer at a campus bar with Bitcoin.

The second key component to be considered a currency is it a good "store of value"? While the value of any currency fluctuates constantly, in relation to other currencies, it ideally should be fairly stable, and not terribly volatile. Early currency was coin based in various precious metals. The earliest known concept of paper currency is from China in 1000 BC. The acceptance of a piece of paper in return for something of value took a long while to catch on. According to the UN, there are 180 national currencies in circulation. Another 66 countries either use the US dollar or peg their currency directly to the US dollar. Without a government regulation and elevated volatility, we do not believe that Bitcoin can easily answer this question either.

Does Gen Z truly understand the main function of cryptocurrency? Their thoughts seemed to be mixed. When asked if Bitcoin's main purpose is to serve as either a medium of exchange or act as an asset class, 72% of our respondents perceived the latter.

Last year, 63% of our initial survey believed Bitcoin was an asset class. Using solely last year as a benchmark, Gen Z is increasingly viewing crypto as an investment vehicle. This evidence could raise concern to the validity of using cryptocurrencies as a form of payment and might explain why such a large percentage of Gen Z still has not jumped on the crypto bandwagon.

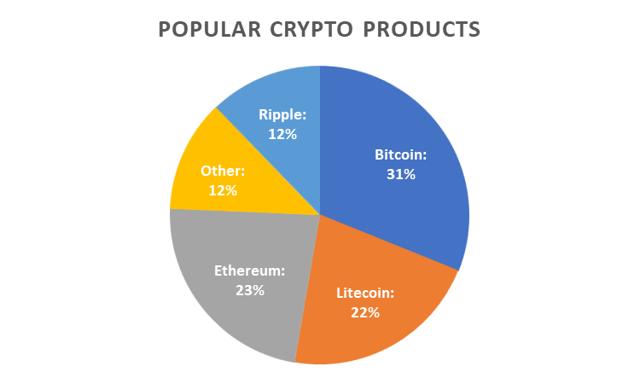

For the respondents who do own cryptos, we wanted to gain insight into which ones are most popular amongst Gen Z. Not surprisingly, Bitcoin came in first at 31%, followed by Ethereum (23%), Litecoin (22%), and Ripple (12%).

This is the first year we asked our respondents to reveal their specific ownership. As the digital currency landscape evolves and new coin offerings come to market, it will be particularly interesting to see how these results change.

Where are Gen Zs going to trade cryptocurrencies? We asked which platforms they use to buy and sell their digital coin. Coinbase, being the most mainstream service provider, came in first at 44%, followed by Binance (20%), Robinhood (13%), Kraken (10%).

Similar to the previous survey question, we will begin tracking the annual deltas of this specific response as digital currencies evolve in the market.

Will there ever be another digital currency to rival Bitcoin's dominance? Well, Facebook (NASDAQ:FB) and multiple partners just launched Libra last month. Our survey was conducted before Libra's announcement, so we unfortunately did not have an opportunity to question our participants.

Facebook has revealed the details of its cryptocurrency. The currency will let you buy things or send money to people, with nearly no fees. In theory, you will anonymously buy or cash out your Libra online or at local exchange points. Also, users can spend their Libra on Facebook's own application or wallet called Calibra, or on other third-party wallet apps.

Facebook won't fully control Libra, but instead will have a single vote in its governance. Other founding members of the Libra Association, including Visa, Uber (NYSE:UBER) and Andreessen Horowitz, have invested at least $10 million each into Libra's operations. The association will promote the open-sourced Libra Blockchain and its developer platform, as well as with its unique Move programming language.

Fed Chair Jerome Powell just poured cold water on Libra, stating that it "raises serious concerns regarding privacy, money laundering, consumer protection, and financial stability." In his testimony before the House Financial Service Committee, he specifically stated that Libra "should not go forward" without addressing all of his concerns. The price of Bitcoin in response fell significantly. The market is still hesitant to implement digital currencies in day-to-day payments. Therefore, Libra's response to the issues outlaid by Powell will dictate much of its success. Is this the end of digital currencies and Bitcoin? Absolutely not! However, governments, central banks and traditional financial entities can continue to make it difficult for digital currencies to succeed.

Despite disagreeing with Chairman Powell on the pace of change of interest rates, just yesterday, President Trump echoed similar digital currency dissatisfaction. President Trump tweeted:

Then, President Trump tweeted specifically about Libra and said,

Manole Capital Management recently published a detailed analysis of Libra, with its pros and cons. If you would like to read that note, titled "If Facebook And Bitcoin Had A Baby", please click here.

In addition, Manole Capital published a note on Bitcoin in December of 2017, prior to its peak price of nearly $20,000. If you wish to read that note, titled "The Safer Way To Play Bitcoin", just click here.

We believe that cryptocurrencies have struggled to become a widespread "medium of trade". To receive widespread merchant adoption, it will require acceptance by the key merchant acquirers and processors, as well as the payment networks. Without integration with these key payment players, retailers and merchants will not be able to accept digital currencies as payments. For this process to occur, it will ultimately require bank and financial institution acceptance, since proceeds will need to be deposited somewhere. Because of this fact, and that most digital currencies are anonymous, this may remain a challenge.

As we continue to highlight, we believe governments and central banks around the world will find it difficult to allow digital currencies to thrive. If a central bank losses control over its sovereign currency, it could lead to utter chaos. Bitcoin bulls will argue that no one country should control that type of power. We argue that the US dollar, the euro and a few other select currencies (British pound, Swiss franc, Chinese yuan) already control global commerce. To displace them will be a herculean feat. Simple comments that classify digital currencies as untraceable and only facilitating drug trades and unlawful activities will further this perception.

Despite its volatility, some investors have found Bitcoin to be useful as a store of value. During this trade dispute, between the US and China, Bitcoin has surged. Some consider it to be a useful and uncorrelated hedge against traditional fiat currencies. Like gold in prior periods, which acted as a hedge during times of stress, some are using Bitcoin as a store of value.

We conclude that adoption of digital currencies by Gen Z is still quite unpredictable. The meteoric rise in 2017 and its rapid fall in 2018 have burned many Gen Z speculators. Without easy and practical uses and applications, digital currencies will languish. With significant volatility, Gen Z will be hesitant. If the digital currency ecosystem can begin to solve some of their issues, Gen Z will be early adopters. The biggest advantage digital currencies have is that Gen Z is much more interested in technological innovation (i.e., blockchain) than traditional methodologies. If digital currencies can somehow claim the "cool factor", it can possibly succeed.

So far, digital currencies with the best success seem to be the "first-to-market" influencers, such as Bitcoin. The cryptocurrencies that are most efficient in using blockchain technology and are the safest will likely become the most popular. Similarly, those platforms providing access to various digital currencies at reasonable trading and storage costs will likely succeed. Coinbase was the first to provide access to trading of all major cryptos on one seamless platform. The large online brokerages (Schwab, TD Ameritrade, E*Trade, Fidelity, etc.) have stayed out of this business, for now...

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer Firm: Manole Capital Management LLC is a registered investment adviser. The firm is defined to include all accounts managed by Manole Capital Management LLC. In general: This disclaimer applies to this document and the verbal or written comments of any person representing it. The information presented is available for client or potential client use only. This summary, which has been furnished on a confidential basis to the recipient, does not constitute an offer of any securities or investment advisory services, which may be made only by means of a private placement memorandum or similar materials which contain a description of material terms and risks. This summary is intended exclusively for the use of the person it has been delivered to by Warren Fisher and it is not to be reproduced or redistributed to any other person without the prior consent of Warren Fisher. Past Performance: Past performance generally is not, and should not be construed as, an indication of future results. The information provided should not be relied upon as the basis for making any investment decisions or for selecting The Firm. Past portfolio characteristics are not necessarily indicative of future portfolio characteristics and can be changed. Past strategy allocations are not necessarily indicative of future allocations. Strategy allocations are based on the capital used for the strategy mentioned. This document may contain forward-looking statements and projections that are based on current beliefs and assumptions and on information currently available. Risk of Loss: An investment involves a high degree of risk, including the possibility of a total loss thereof. Any investment or strategy managed by The Firm is speculative in nature and there can be no assurance that the investment objective(s) will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. Distribution: Manole Capital expressly prohibits any reproduction, in hard copy, electronic or any other form, or any re-distribution of this presentation to any third party without the prior written consent of Manole. This presentation is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to local law or regulation. Additional Information: Prospective investors are urged to carefully read the applicable memorandums in its entirety. All information is believed to be reasonable, but involve risks, uncertainties and assumptions and prospective investors may not put undue reliance on any of these statements. Information provided herein is presented as of December 2015 (unless otherwise noted) and is derived from sources Warren Fisher considers reliable, but it cannot guarantee its complete accuracy. Any information may be changed or updated without notice to the recipient. Tax, Legal or Accounting Advice: This presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of the US federal tax consequences contained in this presentation were not intended to be used and cannot be used to avoid penalties under the US Internal Revenue Code or to promote, market or recommend to another party any tax related matters addressed herein.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Gen-Z • Bitcoin • Gen-Z • Millennials • Gen-Z • Demography of the United States • Gen-Z • United States dollar • Internet • IPhone • Steve Jobs • Gen-Z • Gen-Z • Consumer • Brand • Corporation • Entrepreneurship • Multiculturalism • Capital (economics) • Financial technology • Industry • Goal • Research • Insight • Financial services • Categorization • Information • Gen-Z • Perception • Millennials • Gen-Z • Society • Gen-Z • Millennials • Generation X • Baby boomers • Baby boomers • Demography • United States • South America • Middle East • East Africa • Europe • University of Tampa • Florida • Business • Definition • Financial technology • Technology • Scientific method • Algorithm • Financial technology • Digital currency • Bitcoin • Financial technology • Digital currency • Digital currency • Proof of concept • David Chaum • DigiCash • BitGold • Bitcoin • Blockchain • Ledger • Digital currency • Bitcoin • Blockchain • Blockchain • Public Ledger (Philadelphia) • Record (computer science) • Database transaction • Bitcoin • Peer-to-peer • Process (computing) • Authentication • Digital currency exchange • Digital currency • Cryptography • Encryption • Blockchain • Fraud • Double-spending • Cryptographic hash function • SHA-2 • Blockchain • Ledger • Bitcoin • Digital currency • Bitcoin • Litecoin • Ethereum • Dash (cryptocurrency) • Visa Inc. • New York Stock Exchange • Credit card • Cryptocurrency • Cryptocurrency • Market (economics) • Digital currency • Cryptocurrency • Digital currency • Currency • Asset • Medium of exchange • Goods • Currency • Digital currency • Bitcoin • Currency • Store of value • Currency • Currency • Volatility (finance) • Coin • Precious metal • Banknote • China • United Nations • Currencies of the European Union • United States dollar • Fixed exchange-rate system • Currency • United States dollar • Volatility (finance) • Bitcoin • Gen-Z • Cryptocurrency • Bitcoin • Medium of exchange • NSB Class 72 • Bitcoin • Gen-Z • Cryptography • Cryptocurrency • Theory of Forms • Gen-Z • Cryptography • Argumentum ad populum • Gen-Z • Bitcoin • Ethereum • Litecoin • Digital currency • Coin • Market (economics) • Coin • Zimbabwean dollar • Cryptocurrency • Coin • Coinbase • Kraken (bitcoin exchange) • Digital currency • Market (economics) • Digital currency • Bitcoin • Facebook • NASDAQ • Ancient Roman units of measurement • Ancient Roman units of measurement • Facebook • Cryptocurrency • Currency • Money • Ancient Roman units of measurement • Internet • User (computing) • Microsoft Academic Search • Facebook • Application software • Opel Calibra • Mobile app • Facebook • Microsoft Academic Search • Libra (Toni Braxton album) • Visa Inc. • Uber (company) • New York Stock Exchange • Uber (company) • Andreessen Horowitz • Microsoft Academic Search • Instruction set • Open-source software • Microsoft Academic Search • Blockchain • Software developer • Programming language • Chair of the Federal Reserve • Microsoft Academic Search • Privacy • Money laundering • Consumer protection • Financial services • Ancient Roman units of measurement • Price • Bitcoin • Market (economics) • Digital currency • Payment • Ancient Roman units of measurement • Digital currency • Bitcoin • Government • Central bank • Finance • Digital currency • Interest rate • Donald Trump • Digital currency • Libra (astrology) • Ancient Roman units of measurement • Facebook • Bitcoin • Bitcoin • Bitcoin • Cryptocurrency • Trade • Merchant • Payment • Computer network • Payment • Retail • Merchant • Digital currency • Payment • Business process • Bank • Financial institution • Question of law • Digital currency • Anonymity • Government • Central bank • Digital currency • Central bank • Sovereign (British coin) • Currency • Bitcoin • Market trend • United States dollar • Euro • Currency • Pound sterling • Swiss franc • Chinese yuan • International trade • Digital currency • Volatility (finance) • Investment • Bitcoin • Store of value • United States dollar • China • Bitcoin • Correlation and dependence • Hedge (finance) • Fiat money • Gold • Hedge (finance) • Bitcoin • Store of value • Digital currency • Gen-Z • Gen-Z • Speculation • Digital currency • Volatility (finance) • Gen-Z • Digital currency • Ecosystem • Gen-Z • Digital currency • Gen-Z • Innovation • Industrial engineering • Blockchain • Digital currency • Digital currency • Bitcoin • Cryptocurrency • Blockchain • Digital currency • Coinbase • Brokerage firm • Charles Schwab Corporation • TD Ameritrade • E-Trade • Fidelity Investments • Corporation • Stock • Seeking Alpha • Company • Stock market • Corporation • Business • Capital (economics) • Management • Limited liability company • Registered Investment Adviser • Business • Financial statement • Capital (economics) • Management • Limited liability company • Document • Person • Information • Customer • Consumer • Confidentiality • Security (finance) • Service (economics) • Prospectus (finance) • Warren Fisher • Not to be Reproduced • Consent • Warren Fisher • Future • Belief • Presupposition • Information • Investment • Business • Nature • Life insurance • Investment • Investment • Risk • Investment • Capital (economics) • Electronics • Religious education • Writing • Consent • Person • Entity • Jurisdiction • Nation state • Regulation • Information • Investment • Information • Reason • Risk • Uncertainty • Presupposition • Investment • Information • Warren Fisher • Reliability engineering • Accuracy and precision • Information • Tax • Law • Accounting • Accounting • Law • Tax • Tax • Sanctions (law) • Internal Revenue Code • Market (economics) • Tax •