Castle Biosciences Readies Plans For $50 Million IPO - 7 minutes read

Castle Biosciences Readies Plans For $50 Million IPO - Castle Biosciences (Pending:CSTL)

Castle Biosciences Readies Plans For $50 Million IPO - Castle Biosciences (Pending:CSTL)The company provides genetic tests for skin and ocular cancers.

CSTL has grown quickly, is producing positive results for various major metrics, and has investor support for the IPO.

Castle Biosciences (CSTL) has filed to raise $50 million in an IPO of its common stock, according to an S-1/A registration statement.

The firm is developing and commercializing a suite of genomic tools to assist in the diagnosis and treatment of skin and uveal cancers.

CSTL is showing accelerating growth, positive cash flow from operations, strong investor support for the IPO and near-breakeven operating margin, so the IPO looks interesting within its proposed price range.

Friendswood, Texas-based Castle Biosciences was founded in 2007 to bring 'actionable genomic information to the diagnosis and treatment of skin and uveal cancers'.

Management is headed by founder and CEO Derek Maetzold, who has held senior roles at Encysive Pharmaceuticals, Schering-Plough, Amylin Pharmaceuticals, and Sandoz Pharmaceuticals.

Investors in the firm include Sofinnova HealthQuest, MGC Venture Partners, Industry Ventures Healthcare, BioBrit and SH Castle Biosciences.

Below is a brief overview video of one of the firm’s tests:

The firm has developed or is developing genomic tests for skin and uveal (ocular) cancers as follows:

Castle sells its testing services via a direct sales force of 35 individuals in 23 territories and also has a ‘medical affairs group’ which it uses to educate physicians and enhance its marketing efforts.

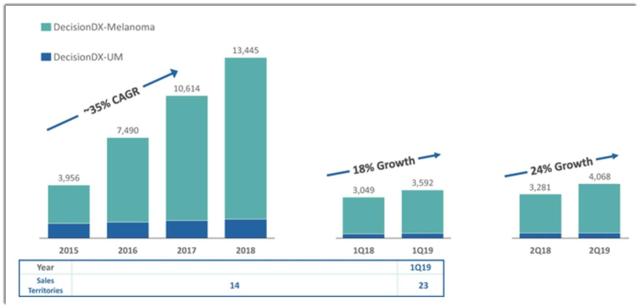

Below is a company-provided chart on the growth in number of genetic profiling reports in recent years:

Selling, G&A expenses as a percentage of revenue have been dropping as revenues have increased, as the figures below indicate:

The selling, G&A efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of selling, G&A spend, increased to 0.8x in the most recent period, indicating increased capital efficiency, as shown in the table below:

Skin cancer is the most common form of cancer in the U.S. According to a 2017 market research report by Grand View Research, the melanoma therapeutics market was $4.2 billion in 2016.

The market was expected to grow at a CAGR of 11.21% from 2014 through 2025, as shown in the chart below:

Per the World Health Organization, 132,000 cases of skin cancer are diagnosed each year, with a forecasted increase of 4,500 cases worldwide as a function of the reduction of ozone levels in the years to come.

The Asia Pacific market will likely grow at a strong rate due to a rise in the incidence of skin cancer and increased demand for lower-cost solutions.

According to a Medgadget report, the melanoma skin cancer diagnostics market is expected to reach $409 million by 2022 and grow at a rate of 7% from 2018 to 2022.

CSTL’s recent financial results can be summarized as follows:

Below are relevant financial metrics derived from the firm’s registration statement:

As of March 31, 2019, the company had $16.2 million in cash and $33.8 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2019, was a negative ($9.0 million).

CSTL intends to sell 3.33 million shares of common stock at a midpoint price of $15.00 per share to raise $50 million in gross proceeds from an IPO.

Certain existing shareholders have indicated an interest to purchase shares of up to $15.0 million in the aggregate at the IPO price. This is a positive signal for prospective IPO investors.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $239.2 million, excluding the effects of underwriter over-allotment options.

Management says it will use the net proceeds from the IPO as follows:

Management’s presentation of the company roadshow is available here.

Listed bookrunners of the IPO are SVB Leerink, Baird, Canaccord Genuity, and BTIG.

CSTL is seeking public capital to both continue its sales and marketing efforts for its existing genetic testing products and continue development on new products.

The company’s financials show accelerating revenue, gross profit and gross margin, as well as reduced operating and net losses and a swing to positive cash flow from operations.

Sales and marketing expenses are dropping as a percentage of total revenue and the firm is becoming more efficient at generating additional revenue.

The market opportunity for skin cancer diagnostics is growing moderately but is still on the small side, at an estimated $409 million by 2022. Still, Castle is growing far faster than the market, so it appears to be taking market share or expanding the market in the process.

As to valuation, management is asking IPO investors to pay an EV/Revenue of 8.6x for its growth trajectory.

While the IPO isn’t cheap, given the firm’s growth prospects, investor support for the IPO, near-breakeven operating margin, and swing to positive cash flow from operations, the IPO looks interesting within its proposed price range.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Biotechnology • Initial public offering • Biotechnology • Genetic testing • Investor • Initial public offering • Biotechnology • Initial public offering • Common stock • Registration statement • Genomics • Tool • Medical diagnosis • Skin • Cancer • Developmental biology • Cash flow • Initial public offering • Operating margin • Initial public offering • Price • Friendswood, Texas • Biology • Genomics • Information • Medical diagnosis • Therapy • Skin • Cancer • Schering-Plough • Amylin Pharmaceuticals • Novartis • Sofinnova • Venture capital • Industry • Health care • Biotechnology • Business • Genomics • Cancer • Experiment • Service (economics) • Direct selling • Sales • Medicine • Marketing • Company • Economic growth • Medical genetics • Percentage • Revenue • Revenue • Efficiency • Interest rate • Revenue • United States dollar • Capital (economics) • Skin cancer • Market research • Melanoma • Compound annual growth rate • World Health Organization • Skin cancer • Ozone • Skin cancer • Solution • Melanoma • Skin cancer • Market (economics) • Finance • Business • Company • Free cash flow • Yamaha S90 • Share (finance) • Common stock • Price • California County Routes in zone S • Share (finance) • Initial public offering • Shareholder • Interest • Share (finance) • Aggregate demand • Initial public offering • Price • Initial public offering • Investor • Initial public offering • Company • Enterprise value • Initial public offering • Underwriting • Option (finance) • Internet • Initial public offering • Initial public offering • Initial public offering • John Logie Baird • Canaccord Genuity • Public capital • Sales • Marketing • Genetic testing • Product (business) • Economic development • Product (business) • Company • Finance • Revenue • Gross profit • Gross margin • Internet • Cash flow • Business operations • Sales • Marketing • Expense • Business • Skin cancer • Market share • Valuation (finance) • Management • Initial public offering • Investor • Enterprise value • Revenue • Initial public offering • Investor • Initial public offering • Break-even (economics) • Operating margin • Cash flow • Initial public offering • Price • Corporation • Stock • Seeking Alpha • Stock market •