Root Insurance valuation hits $3.65 billion in latest round led by DST Global and Coatue - 3 minutes read

Root Insurance valuation hits $3.65 billion in latest round led by DST Global and Coatue – TechCrunch

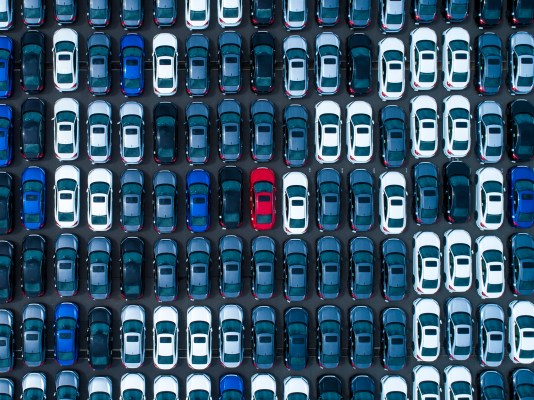

Root Insurance valuation hits $3.65 billion in latest round led by DST Global and Coatue – TechCrunchRoot Insurance, lang="EN">an Ohio-based car insurance startup that uses smartphone technology to understand individual driver behavior, said Monday it has raised $350 million on a $3.65 billion valuation in a Series E funding round.

The amount of the round was reported last month by Axios, citing anonymous sources. This official announcement fills in the remaining details, including that DST Global and Coatue Management led the funding round. Existing investors Drive Capital, Redpoint Ventures, Ribbit Capital, Scale Venture Partners and Tiger Global Management all participated in this round, along with several new investors, according to the company.

The car insurance company, founded in 2015, has now raised $523 million with an additional $100 million in debt financing. The funding will be used to scale up in the 29 U.S. states where it currently operates and expand into new markets. The additional capital will also be used to develop new product lines, Root said.

The company said last year it planned to be in all 50 states and Washington, D.C. by the end of 2019.

“Root is transforming auto insurance, the largest property and casualty insurance market in the U.S., by leveraging technology and data to offer consumers lower prices, transparency, and fairness,” Tom Stafford, managing partner of DST Global, said in a statement.

Root provides car insurance to drivers. The company has differentiated itself by using individual driver behavior along with other factors to determine the premium customers pay.

Drivers download the Rootmobile app and take a test drive that typically lasts two or three weeks. Root provides a quote that rewards good driving behavior and allows customers to switch their insurance policy. Customers can purchase and manage their policy through the app.

Root has said its approach allows good drivers to save more than 50% on their policies compared to traditional insurance carriers.The company uses AI algorithms to adjust risk and sometimes provide discounts. For example, a vehicle with an advanced driver assistance system that it deems improves safety might receive further discounts.

The company’s business model has attracted customers. Root wrote more than $187 million in insurance premiums in the first six months of 2019, 824% growth over the same period in 2018.

Source: TechCrunch

Powered by NewsAPI.org

Keywords:

Nantucket, Massachusetts • TechCrunch • Ohio • Vehicle insurance • Smartphone • Technology • Vardar • Coatue Management • Drive Capital • Redpoint Ventures • Scale Venture Partners • Tiger Management • Vehicle insurance • Insurance • Debt • Funding • Market (economics) • Capital (economics) • Corporation • Washington, D.C. • Vehicle insurance • Market (economics) • Technology • Consumer • Price • Transparency (behavior) • Thomas P. Stafford • Globalization • Financial statement • Vehicle insurance • Company • Insurance • Mobile app • Customer • Mobile app • Goods • Policy • Company • Artificial intelligence • Algorithm • Risk • Vehicle • Advanced driver assistance systems • Company • Business model • Customer • Insurance • Insurance • Economic growth •