Big News From Europe For Intel And Qualcomm - 10 minutes read

Big News From Europe For Intel And Qualcomm - Intel Corporation (NASDAQ:INTC)

Big News From Europe For Intel And Qualcomm - Intel Corporation (NASDAQ:INTC)The chances are increasing that the respective chipsets can be used quickly in Europe. Intel and Qualcomm can be the first companies to build up market shares in Europe - a huge advantage.

Qualcomm (QCOM) and Intel (INTC) are having a lot of problems right now. While Qualcomm is struggling with regulatory issues, Intel is trying not to lag behind AMD (AMD). Hardly noticed by investors, something trend-setting has happened in Europe, which will appeal especially to Qualcomm and Intel. The EU member states stopped a new Wi-Fi standard for autonomous driving in the EU. The planned Wi-Fi standard was rejected by a qualified majority of 21 states. This sets the course for the 5G standard in Europe. Qualcomm and Intel, in particular, will benefit from this. In the following, I will explain why this is the case.

The future of automotive is determined not only by robotics and artificial intelligence but also by connecting cars with their surrounding. 5G is generally considered to be decisive in this respect. With 5G, there will be a completely new market with an impressively high market volume. After a ramp-up period in the late 2020s and early 2030s, it is estimated that the total global sales enablement potential of 5G to reach USD 12.3 trillion in 2035. Of this, USD 2.4 trillion will be felt in the automotive sector.

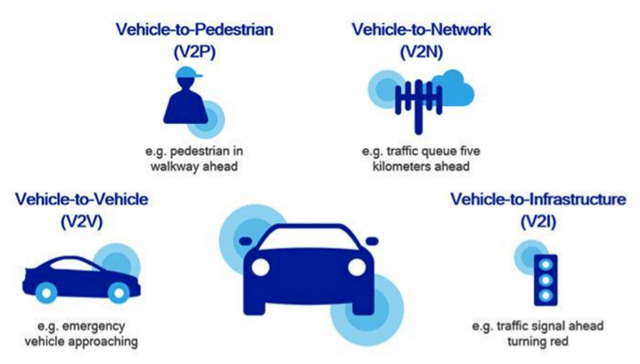

V2X or the communication between vehicle and everything is a form of technology that allows vehicles to communicate with moving parts of the transport system. V2X consists of several components: Vehicle-to-Vehicle (V2V), Vehicle-to-Road (V2R), Vehicle-to-Infrastructure (V2I), Vehicle-to-Network (V2N), and Vehicle-to-Person (V2P):

While 5G is broadly known as a possible catalyst for the connected automotive, with Wi-Fi exists another technology for connecting cars with their environment. This issue has led to two opponent groups of companies. At the one end, Volkswagen (OTCPK:VLKAF), Renault (OTCPK:RNLSY), and NXP (NXPI) wanted to push Wi-Fi. On the other side were BMW (OTCPK:BMWYY), Daimler (OTCPK:DDAIF), Ford (FORD), Huawei, Intel, Qualcomm, and Samsung (SSNFL, OTC:SSNNF) which have backed 5G. Now, the EU member states have stopped the approach for a new Wi-Fi standard.

Qualcomm and Intel win the most from this decision. Europe is currently making strong efforts to close the digital divide with other countries. Accordingly, there is a good chance that the implementation of the 5G standard will be pushed forward politically. Hence, there will be a strong demand for 5G chipsets. The resulting market is huge. The global 5G chipset market was valued at USD 1.21 billion in 2017 and is expected to reach USD 9.22 billion by 2026 with a CAGR of 41.2 percent.

In Europe, Qualcomm and Intel will more or less divide the market among themselves for 5G automotive chipsets. While NXP initially focused on Wi-Fi, Huawei is struggling with political resistance. European companies are very afraid of sanctions if they cooperate with Huawei. There are also growing security concerns about Huawei in Europe. It is, therefore, to be expected that car manufacturers will use chipsets from Qualcomm or Intel. On the other hand, Qualcomm and Intel have been ahead of the game and set their sights on 5G right from the start.

Intel, in turn, left the 5G smartphone modem business to instead focus on opportunities for 4G and 5G modems in PCs, internet of things devices, and other data-centric devices. The company has also presented 5G chipsets for automotive. Some relevant Intel products include:

Last year, Qualcomm introduced the Qualcomm 9150 C-V2X Chipset as a part of its C-V2X platform. This chipset is already compatible with 5G. Furthermore, the chipset is already being designed into Roadside Units (RSUs), Onboard Units (OBUs), and modules used for automotive safety and traffic efficiency.

Accordingly, the European decision is super for both companies. The chances are increasing that the respective chipsets can be used quickly in Europe. Both companies can then be the first to build up market shares in Europe - a huge advantage.

However, it should also be borne in mind that both companies still face some problems. Intel faces its eternal battle with AMD and struggles to keep up with AMD. The company cannot compete with AMD's CPUs with regard to both price and power consumption. Intel also seems to be losing ground in the data center war. Furthermore, Intel has more than USD 25 billion long-term debts, and it also needs to prove that its 5G chipsets are powerful enough to compete with Qualcomm. Qualcomm, on the other hand, has many problems with competition authorities. In 2015, the European Commission has opened two formal antitrust investigations into possible abusive behavior by Qualcomm in the field of baseband chipsets used in consumer electronic devices. While one procedure has already been completed, the second seems to be nearing its end as well. In the USA, the FTC pursued an antitrust case against Qualcomm in 2017. After hearing arguments from both sides, Judge Lucy Koh drew a number of conclusions when she ultimately ruled against Qualcomm, which are pointed out in another analysis here on Seeking Alpha. However, these are the everyday problems that investors in both companies have to live with. The decision in Europe should provide some joy in the face of these concerns. In addition, both companies are relatively cheaply valued for the coming years.

While Intel is valued lower at least for 2018, 2019, and 2020, Qualcomm will pay a higher dividend.

Personally, however, I consider the possibility of regulatory measures to Qualcomm to be quite high. I have a pretty concrete approach to such threats. Given that one threat does not necessarily weigh as much as another threat, investors have to perform very thorough due diligence. The decisive factors are the business models and how these business models would react to antitrust regulation. When it comes to the investigation of the European Commission, a fine is likely. However, this fine will only be a one-time charge. It will considerably hurt the profit for one year, but beyond that, it will have no further effect. After the Apple (NASDAQ:AAPL) agreement, Qualcomm is also liquid enough to pay the fine. Accordingly, investors should not sell because of the threat of a fine. Additionally, the U.S. Justice Department asked a federal appeals court to pause the enforcement of a sweeping antitrust ruling against Qualcomm. When it comes to the investigations by the FTC, the FTC will not prohibit Qualcomm from taking fees. It will only prohibit Qualcomm from taking excessive fees. This may also weaken revenue, but it will not affect the overall business and Qualcomm's know-how. Furthermore, the future market with 5G chips is not affected.

The investors' key takeaway is that the time of talk is gradually over, and the implementation of the first 5G applications is now imminent. The automotive sector will have a significant share in this and will make up an important part of the market volume. Europe has just decided in favor of 5G and against temporary Wi-Fi solutions in an extremely important but hardly noticed decision.

Qualcomm and Intel were on the right side from the start and will be the first to capture market share with their existing chipsets. In addition, both companies are relatively cheaply valued. Investors, however, must take into account Intel's strong competition and Qualcomm's regulatory risks. For Qualcomm, the recent events have even reduced the risk of further possible regulations. At least for Qualcomm, however, the recent events have reduced the risk of further possible regulations.

If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article and check "Get email alerts".

Disclosure: I am/we are long QCOM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Europe • Qualcomm • Intel • NASDAQ • Intel • Chipset • Europe • Qualcomm • Europe • Qualcomm • Qualcomm • Intel • Intel • Qualcomm • Intel • Advanced Micro Devices • Advanced Micro Devices • Europe • Qualcomm • Intel • Member state of the European Union • Wi-Fi • Autonomous car • European Union • Wi-Fi • Supermajority • Europe • Qualcomm • Car • Robotics • Artificial intelligence • Car • Market (economics) • Multinational corporation • United States dollar • United States dollar • Vehicle-to-everything • Communication • Vehicle • Technology • Vehicle • Vehicle-to-everything • Vehicle-to-vehicle • Vehicle-to-vehicle • Road • Infrastructure • Computer network • Catalysis • Automotive engineering • Wi-Fi • Technology • Car • Company • Volkswagen • Renault • NXP Semiconductors • NXP Semiconductors • Wi-Fi • BMW • Daimler AG • Ford Motor Company • Ford Motor Company • Huawei • Intel • Qualcomm • Samsung • OTC Markets Group • 5G • Wi-Fi • Standardization • Qualcomm • Intel • Europe • Digital divide • Goods • Standardization • Supply and demand • Market (economics) • Chipset • United States dollar • United States dollar • Compound annual growth rate • Europe • Qualcomm • Intel • Marketing • 5G • Automotive industry • NXP Semiconductors • Wi-Fi • Huawei • Huawei • Security • Huawei • Europe • Qualcomm • Intel • Qualcomm • Intel • 5G • Intel • 5G • Smartphone • Modem • 4G • 5G • Personal computer • Internet of things • Electronics • Electronics • Company • Automotive engineering • Intel • Qualcomm • Qualcomm • Vehicle-to-everything • Chipset • Vehicle-to-everything • Chipset • Chipset • Automobile safety • Europe • Europe • Intel • Advanced Micro Devices • Advanced Micro Devices • Advanced Micro Devices • Central processing unit • Intel • Data center • Intel • United States dollar • Qualcomm • Qualcomm • Competition law • Authority • European Commission • Competition law • Qualcomm • Baseband • Consumer electronics • Consumer electronics • Federal Trade Commission • Competition law • Qualcomm • United States district court • Lucy H. Koh • Qualcomm • Seeking Alpha • Europe • Intel • Qualcomm • Dividend • Qualcomm • Due diligence • Business model • Business model • Competition law • Regulation • Criminal procedure • European Commission • Profit (economics) • Apple Inc. • NASDAQ • Qualcomm • Market liquidity • Investment • United States Department of Justice • United States courts of appeals • Law enforcement • Competition law • Qualcomm • Federal Trade Commission • Federal Trade Commission • Qualcomm • Qualcomm • Revenue • Business • Qualcomm • Marketing • Integrated circuit • Market (economics) • Europe • Wi-Fi • Qualcomm • Intel • Market share • Company • Intel • Competition (economics) • Qualcomm • Regulation • Qualcomm • Risk management • Regulation • Qualcomm • Email • Corporation • Qualcomm • Seeking Alpha • Stock •