2 Income-Generating Option Trades I Like Right Now - 16 minutes read

2 Income-Generating Option Trades I Like Right Now

2 Income-Generating Option Trades I Like Right NowMany dividend investors are highly concentrated in certain sectors, but there are ways to generate yield from option premiums on other assets for diversification.

Disney has surged 25% in less than three months, and is a good candidate for covered calls at this price level.

The iShares MSCI Brazil Capped ETF is volatile, and this article presents an option strategy to buy the dips, sell the rips, and generate income along the way.

Selling options in certain circumstances allows investors to benefit from volatility and generate substantial income from assets that don’t otherwise provide high yields.

Investing in high-yield stocks is quite popular, especially among retired investors. However, as I wrote in my article on 20+ safe high yield stocks, a lot of the companies with high yields are concentrated in a handful of industries such as REITs, MLPs, BDCs, and telcos.

Investors take on concentration risk if they strictly invest in high-yielding companies, and important segments of the market may be under-represented in their portfolios.

Selling covered calls and cash-secured puts can provide yield-hungry investors with some cash on the back of assets that are significantly uncorrelated with those traditional high-yielding industries. That way, you can have broader portfolio exposure and diversification while still focusing mainly on income generation.

Even for growth investors, options can provide a lot of flexibility. While the bulk of my portfolio is simply invested in stocks without options positions, at any given time I am often looking to benefit from volatility in a handful of stocks or ETFs somewhere by selling options.

Here are two income-focused trades I like right now.

I have a long-term bullish outlook on the Walt Disney Company (DIS).

Back in April, I had an interview with WRKO radio, posted here on Seeking Alpha, where I made a bullish case for Disney (and also described why I’m not very bullish on Netflix (NASDAQ:NFLX)).

I then followed up with more thoughts in this article, where I elaborated in writing on some points I made in the interview and reiterated my view of the company.

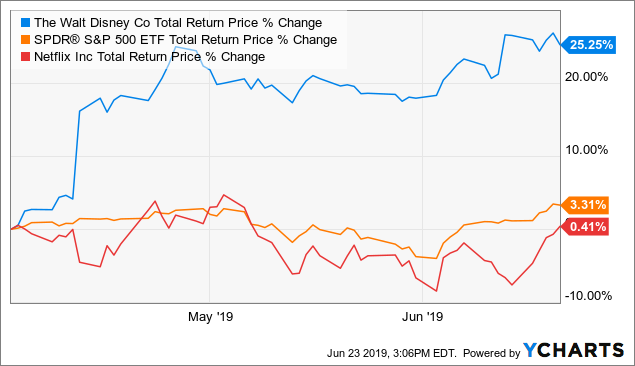

As luck would have it, we’ve had quite a move since then, with Disney’s total returns up by about 25% in less than three months, dramatically outpacing the broader market as well as Netflix:

My thesis was that Disney is a very high-quality company and was trading for a surprisingly reasonable valuation. The stock had been stuck in a trading range for years due to a period of mild overvaluation as fundamentals caught up, and I believed that the market was underestimating Disney’s launch into the streaming business and the potential to make money multiple times from each piece of content they can produce.

Netflix’s model is currently free cash flow negative, as it is very expensive to produce a large volume of high-quality content.

Disney, however, has multiple ways to profit from each piece of content they create. They can make a movie and have it become immediately profitable in theaters. Then when it comes out of theaters, they can add it to their upcoming streaming service, put it on their television channels, and sell some physical copies or digital downloads of it. If the content is for young people, they can make a ride out of it at one of their world class theme parks and bring in more visitors, and they can bring in plenty of merchandising revenue from games or toys.

Additionally, long-lasting franchises are important. The majority of Netflix content likely has no legs, meaning that each piece of content they create may be compelling this year or next, but it’s unlikely to be a timeless show or movie that people go back and watch five years from now or that can spawn a ton of sequels. A significant exception was Stranger Things, where they created a whole new sci-fi world that they can build on for a long time if they want to.

In contrast, Disney is the king of building and buying franchises. In addition to the ever-popular Disney animated classics, their content from Pixar, Marvel, and Star Wars builds upon strong foundations, and thanks to the Fox (NASDAQ:FOX) acquisition, they plan to build the world of Avatar into a franchise.

The market has since woken up to Disney’s potential faster than I would have guessed. Unfortunately, success has the potential to breed mediocrity. Now that Disney has surged by 25%, the gap between what I think the stock is worth compared to what the market thinks it is worth is closed. I expect Disney to do well for a long time with ups and downs along the way, but my conviction that they will beat the market over a 3-year period is diminished from this new valuation level. I simply don’t know.

For my real-money model newsletter portfolio, I'll continue to dollar-cost average into this high-quality stock. The dividend stock section of the portfolio is mostly equal-weighted, so money will naturally flow in whenever Disney lags some of the other stocks in the collection.

For investors that own 100 or more shares of Disney, I like the September 20, 2019 covered call options at a strike price of $155. As of this writing, they pay $1.50 per share in premiums and leave a nearly $15 gap (or over 10% in percentage terms) between the current price and the strike price.

There’s not much of a catalyst besides increased investor enthusiasm over the next three months that should make the price jump that high. If it does jump that high in such a short period after already jumping 25% in less than three months, it would be reasonable to recycle that capital in some other stock that you think has a gap between long-term fair value and the short-term focused market value.

The exact option price for this trade will vary as people read this, but that strike price and time frame is a solid one in my opinion. Investors that sell the option as it’s priced currently would receive more than a 1% premium on the current stock price over a 3-month period, which translates into a better-than 4% premium if annualized. This would be on top of the stock’s 1.2% annual dividend yield while leaving a nice 10%+ gap for 3-month potential capital gains.

This strategy allows investors that are long-term bullish on Disney to capture some additional income and returns from it along the way. So, if the stock moves down, sideways, or moderately up for the next three months, Disney's stock with an out-of-the-money covered call contract on it would outperform the stock itself.

The risk of this strategy is that if the stock surges past about $157 within three months, it would have been better to leave it uncovered.

As I describe in my tutorial on covered calls, the goal for any option I personally sell is to be neutral about whether it is exercised or not. If Disney surges that high in such a short time, I’d be happy to take the gains and reinvest that capital elsewhere. Alternatively, if Disney slumps or just chugs along, then the extra yield on a good wide-moat stock is welcome.

One of my favorite ETFs to sell options on is the iShares MSCI Brazil Capped ETF (EWZ). It’s among the oldest and most liquid single-country ETFs, has plenty of volatility for high option premiums, and is somewhat uncorrelated to what’s going on in the United States in any given quarter.

Looking back a long time, Brazil had a period of bubble valuations in 2007 along with the other BRIC countries as well as a period of deep undervaluation during the darkest days of the country’s recession in 2015/2016.

Brazil’s stock market capitalization reached 98% of the country’s GDP in 2007, which is quite high for an emerging market. Their CAPE ratio was well over 30x at the time as well.

Fast-forward to 2015/2016, the country’s stock market capitalization declined to only 35% of GDP, and their CAPE ratio went as low as 9x. Valuations were down to a third of what they once were.

After a substantial recovery, valuations are no longer depressed, nor are they particularly high. The ratio of stock market capitalization to GDP is a bit under 50%, and the country’s CAPE ratio is about 18x. According to MSCI, the trailing P/E is a bit under 15, the forward P/E is a bit under 12, and the P/B sits at about 2.1x.

On the surface, this is much cheaper than the S&P 500, but Brazil’s large cap index has about 40% exposure to banks and nearly 30% in commodities. It has a significant lack of technology companies in terms of market capitalization. In comparison, the Financial Select Sector SPDR ETF (XLF), which tracks U.S. financials, is cheaper than the Brazilian market in terms of P/E and P/B.

Brazil has had one of the top stock markets in 2019 due to increased optimism about Brazilian politics and other factors, but continues to have substantial risk. I don’t have a strong opinion for its movement during the second half of 2019, and am content to use options to get paid to buy the dips and sell the rips for this market and benefit from its heightened volatility.

I’ve been holding the Brazil ETF since 2017, with occasional option positions on it along the way. Most recently, in late February of this year, I sold covered calls on my position for $1.27/share at a strike price of $48 for June 21, leaving plenty of upside potential from the price of $43 that it was at during that time. The price has been flat and choppy since then, and my (recently profitably-expired) options generated an extra 2.95% in income on my Brazil position in under 4 months without being exercised.

Going forward, I’m looking to re-establish my covered call position by selling the September 20, 2019 covered calls at a higher strike price of $50, which currently offer about $0.63/share in premiums.

If unexercised, this would equal about 1.4% in extra income on my position in less than 3 months, or about 5.8% annualized. The ETF pays a 2-3% dividend yield (subject to business conditions and currency exchange rates), so this strategy can generate in the ballpark of 8% annual returns in a scenario where Brazil’s market remains flat, while also allowing for substantial upside potential.

If I did not already own the Brazil ETF, I would consider selling the September 20 2019 puts (cash-secured) at a strike price of $40, which are currently paying $1.02 in premiums.

If the Brazil ETF remains above $40 over the next three months (up, flat, or mildly down from its current price of over $44), this position would generate approximately 2.6% returns, which equates to well over 10% annualized returns.

On the other hand, if Brazil’s market has a big dip (as it often does), and goes below the strike price, the option would be exercised and the cost basis of this position would be $38.98, which is 12% lower than the current price and very reasonable in my opinion given Brazil's valuation situation.

For either the call or the put on the Brazil ETF, my approach to this would be based on neutrality of outcomes. I’m happy to get paid to wait to buy dips, or to generate extra income from existing positions and sell them if they surge upward. I'll be looking to sell covered calls on my Brazil ETF early this week.

The aspect that turns some investors off from this strategy is that during the 3-month period, the upside potential is capped while the downside potential is significant.

In the unlikely event that Disney goes bankrupt or the Brazilian economy and currency collapses, either investment can theoretically go to zero. In the other unlikely event that either investment were to surge 20-50% in a very short time frame, the option positions would miss out on a significant portion of that massive gain. However, the optioned position outperforms in the broad middle outcome, where the stock or ETF stays flat or goes up or down moderately.

Therefore, it’s important to only use this strategy for a portion of a portfolio. Covered calls are ideal for generating income from positions that are getting a bit frothy but that you don’t yet want to sell and incur capital gains taxes on. Cash-secured puts are ideal for getting paid to wait to buy dips at levels that you have pre-determined to be attractive entry prices for securities that you want to own.

Ideal stocks for this strategy are ones that have a degree of volatility but a wide economic moat, with a strong balance sheet, above-average ROIC, and reasonable valuations. Ideal country ETFs are ones that have sufficient liquidity (many of them do not), and whose markets are trading at reasonable valuations relative to their growth rates and risks.

In other words, selling a cash-secured put on a hot, unprofitable, high-valued tech stock a few months out from an IPO is probably not a good idea for most investors. Similarly, when Brazil and other BRIC countries encountered severe overvaluation in 2007, the downside risk was too great for a strategy like this.

Selling puts and calls is a suitable strategy for entering and exiting positions and generating income, but care should be taken about which securities are selected and how much of one’s portfolio is invested this way.

Many securities are better left for buying and holding, which I do for many of my core positions. For certain stocks and ETFs at the right price, however, selling options can be very lucrative in terms of income potential.

Disclosure: I am/we are long DIS, EWZ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Income • Option (finance) • Trade (financial instrument) • Dividend • Investor • Economic sector • Yield (finance) • Option (finance) • Insurance • Asset • Diversification (finance) • The Walt Disney Company • Call option • Price level • IShares • MSCI • Brazil • Exchange-traded fund • Volatility (finance) • Options strategies • Option (finance) • Investor • Volatility (finance) • Income • Asset • Investment • High-yield stocks • Investor • High-yield stocks • Company • Real estate investment trust • Telephone company • Investor • Concentration risk • Company • Market (economics) • Portfolio (finance) • Call option • Cash • Investment • Cash • Asset • Correlation and dependence • Crop yield • Industry • Portfolio (finance) • Diversification (finance) • Income • Economic growth • Investor • Option (finance) • Portfolio (finance) • Stock • Option (finance) • Volatility (finance) • Stock • Exchange-traded fund • Option (finance) • Trade (financial instrument) • Long-Term Capital Management • Market trend • The Walt Disney Company • WRKO • Seeking Alpha • Market trend • The Walt Disney Company • Market trend • Netflix • NASDAQ • Netflix • The Walt Disney Company • Market (economics) • Netflix • The Walt Disney Company • Company • Financial market • Valuation (finance) • Stock • Financial market • Valuation (finance) • Fundamental analysis • Market (economics) • The Walt Disney Company • Streaming media • Business • Netflix • Mathematical model • Free cash flow • The Walt Disney Company • Streaming media • Music download • Product (business) • Revenue • Netflix • Stranger Things • Syfy • The Walt Disney Company • Media franchise • The Walt Disney Company • Pixar • Marvel Entertainment • Star Wars • Fox Broadcasting Company • NASDAQ • Fox Broadcasting Company • Avatar (2009 film) • The Walt Disney Company • The Walt Disney Company • The Walt Disney Company • Portfolio (finance) • Stock • Dividend • Stock • Portfolio (finance) • Money • The Walt Disney Company • Stock • Collection agency • Investor • Share (finance) • The Walt Disney Company • Covered call • Call option • Strike price • Stock • Insurance • Nissan Silvia • Strike price • Capital (economics) • Stock • Fair value • Market value • Valuation of options • Trade • Strike price • Investor • Option (finance) • Stock • Control premium • Dividend yield • Capital gain • Trading strategy • Investor • Market trend • The Walt Disney Company • Rate of return • Stock • The Walt Disney Company • Stock • Moneyness • Covered call • Stock • Risk • Trading strategy • Stock • The Walt Disney Company • The Walt Disney Company • Moat • Stock • Exchange-traded fund • Option (finance) • IShares • MSCI • Brazil • Exchange-traded fund • Market liquidity • Exchange-traded fund • Volatility (finance) • Option (finance) • Correlation and dependence • What's Going On (Marvin Gaye album) • United States • Brazil • Dot-com bubble • BRIC • Recession • Brazil • Stock market • Market capitalization • Gross domestic product • Cyclically adjusted price-to-earnings ratio • The Amazing Race • Stock market • Market capitalization • Gross domestic product • Cyclically adjusted price-to-earnings ratio • Stock market • Market capitalization • Gross domestic product • Cyclically adjusted price-to-earnings ratio • MSCI • Price–earnings ratio • Price–earnings ratio • P/B ratio • S&P 500 Index • Brazil • Market capitalization • Stock market index • Bank • Commodity • Market capitalization • Finance • Standard & Poor's Depositary Receipts • Exchange-traded fund • Non-homologous end-joining factor 1 • Finance • Price–earnings ratio • Brazil • Stock market • Optimism • Risk • Option (finance) • Market (economics) • Employee benefits • Volatility (finance) • Brazil • Exchange-traded fund • Option (finance) • Call option • Strike price • Brazil • Covered call • Call option • Strike price • Insurance • Position (finance) • Exchange-traded fund • Dividend yield • Business • Foreign exchange market • Exchange rate • Trading strategy • Rate of return • Brazil • Market (economics) • Brazil • Exchange-traded fund • Put option • Cash • Strike price • Brazil • Exchange-traded fund • Brazil • Strike price • Option (finance) • Cost basis • Brazil • Brazil • Exchange-traded fund • Brazil • Exchange-traded fund • The Walt Disney Company • Economy of Brazil • Currency • Investment • Short (finance) • Option (finance) • Stock • Exchange-traded fund • Trading strategy • Call option • Income • Capital gains tax • Cash • Price • Security (finance) • Stock • Strategic management • Volatility (finance) • Economy • Moat • Balance sheet • Return on capital • Valuation (finance) • Idealism • Exchange-traded fund • Necessity and sufficiency • Market liquidity • Market (economics) • Reason • Valuation (finance) • Value (ethics) • Economic growth • Risk • Money • Profit (economics) • Technology • Stock • Initial public offering • Investor • Brazil • BRIC • Valuation (finance) • Downside risk • Trading strategy • Option (finance) • Trading strategy • Income • Security (finance) • Portfolio (finance) • Security (finance) • Trade • Stock • Exchange-traded fund • Option (finance) • Income • Corporation • Opinion • Company • Stock •