Bearish Vyleesi Article Omits Key Information. Skeptics Overlooking Clinical Data - 17 minutes read

Bearish Vyleesi Article Omits Key Information. Skeptics Overlooking Clinical Data - AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG)

Bearish Vyleesi Article Omits Key Information. Skeptics Overlooking Clinical Data - AMAG Pharmaceuticals, Inc. (NASDAQ:AMAG)On June 21st, 2019, the second ever treatment for hypoactive sexual desire disorder (HSDD) in women was approved by the FDA. The drug, Bremelanotide (Referred in the article as "Bremo" /" Vyleesi") was developed as a combined R&D effort between Palatin Technologies (PTN) and AMAG Pharmaceuticals (AMAG) over a period of 4 years.

An estimated 11.75 million women in the U.S. alone are affected by HSDD. Furthermore, multiple phase 3 clinical trials evaluating the drug's safety and efficacy have definitively proven, in my view, that 1) The drug indeed works and 2) the rewards of this drug far outweighs its risk (as evident by its FDA vote of confidence). This is the only one out of two approved drugs in the entire world which addresses this large patient size and unmet medical need.

Immediately after its approval, however, Biotech Journalist Adam Feurestein published a bearish critiqued the FDA for its approval. After reading Adam's article and along with a follower request, this prompted me to conduct my own independent analysis as to determine the science and economics behind this drug.

After an evaluation of all sources; clinical data; investor representations; and third party perspectives on the matter, the author comes to a rather intriguing conclusion: the efficacy of Bremelanotide is indeed adequately supported by clinical trial the author has reviewed in this article. On the other hand, Adam Feuerstein should be heralded for his chutzpah against the FDA due to one legitimate concern raised in his article investors in AMAG and PTN may have overlooked. Without further ado, let's find out why:

It has been explicitly stated in PTN's most recent 10-Q filings that the company has a royalties agreement with AMAG in regards to future cash flows from sales of Vyleesi post-approval. This deal entitles PTN to high single to low double digits royalty revenues minus 2% advisory fees paid out to its financial adviser, Greenhill & Co LLC, and applies to all sales of Bremo in North America. As we can see, the royalty deal ends based on the later of either Vyleesi's 1) patent expiration or 2) loss of exclusivity. Let's take a look as to when these protections to PTN and AMAG's intellectual property expire:

As we can see, the existence of such royalty deal until at 2035 is in direct contrast to Adam's claim that "PTN will derive no value from the product". More importantly, this royalties agreements only exists for sales of Vyleesi in North America. Palatin Technologies will have full discretion as to sales; marketing; and licensing of the drug in Europe, Asia, Oceania, Africa. etc. With this claim rebutted, let's move on to the next claim:

There seems to be a lot of conflicting information regarding this one. To get to the bottom of how much revenues Vyleesi can ideally generate, the author has curated the following information about the patient size of women suffering from HSDD after much research:

By obtaining the epidemiological occurrences of the condition by age; the female population in the U.S. by age; multiplying the two and summing its parts, the author estimates there are a total of 11.75 million women in the United States who are suffering from HSDD. Vyleesi is one of the only two FDA approved drug for this indication (the other being Sprout Pharma's Addyi, more on this later) and has patent protection until 2035 to profit from this patient pool. Just how lucrative this drug can be provided execution is reasonable? Let's find out below using Sildenafil (Viagra)'s pricing as a precedent:

First of all, overall # of possible prescriptions is calculated by multiplying the total patient size by age group by the corresponding number of annual sexual occurrences in women with HSDD (as one dose of Bremo only works per one single intercourse), then a summation of its parts. This results in an estimate of 141 million in total possible annual prescriptions in the entire patient market.

Next, the author benchmarks the price of Vyleesi to that of Viagra's before its patent expiry (as generic drugs are on average 90% cheaper than branded ones). This derives an implied pricing of $6.13 per prescription for Vyleesi

Based on the data gathered regarding HSDD patient size; estimated number of annual sexual occurrences in U.S. women with HSDD; pricing of Viagra pre-patent expiry; an implied discount for Vyleesi pricing to this benchmark; and a 10% royalties agreement paid to PTN; the author estimates every 1% of the patient size captured by AMAG's Vyleesi marketing will generate close to $8.6 Million in annual revenues for AMAG in the United States alone. Since the SVB Leerink forecasts only $90 million in peak sales while AMAG's management sees $700 million, let's take a look at what these amount to in terms of patients being prescribed this drug (the "Capture Rate").

Here, the author finds the two estimates to be either completely bullish or completely bearish. Firstly, SVB only forecasts 10.50% of HSDD patients being prescribed Bremo during its peak sales, while management guidance forecasts a whopping 81.00% capture rate during peak exposure. The truth, however, probably lies somewhere in between, as it is important to note these account for only U.S. sales. Women suffering from HSDD in developed Western markets such as the E.U., U.K., Canada, Australia, New Zealand and Japan are not being included in these calculations, and have the potential to add Vyleesi sales even if U.S. prescription volume remains unimpressive.

Lastly, keep in mind these calculations assume a discount rate of 30% vs Viagra. This is because the mechanism of action (MOA) in Bremo is not entirely clear, and clinical trials involving the drug are based on only questionnaires regarding to sexual satisfaction versus observation of erection in Viagra. These factors do take away value and hence are likely to reduce its forward pricing. On the other hand, the argument "this drug will generate minimal revenue" coming from Adam is at best a poor estimate due to the sheer volume of patients affected by HSDD and the superb data from its clinical trials. Let's take a look.

Adam claims only 8% of women who received Bremo treatment saw better results vs. placebo in terms of sexual desire, and only 4% saw efficacy when evaluated in sexual distress. These are rather astonishing claims as this would imply the FDA has approved a drug which contains purely random results in terms of efficacy. To evaluate whether or not this statement is the case, the author has pulled up two phase 3, single/double blinded, randomized clinical trials involving over 1,000 patients (n=1000) treated with Bremo. Let's see how the clinical data compare to the claims:

The author has curated the results into the following table:

Here, the author finds Adam to have understated Vyleesi's efficacy versus placebo by as much as 192% (200% vs 8%) even for the lowest dose of Bremo patients received! Modern pharmaceuticals standard demands at least 25% better efficacy over placebo for a minimum standard of approval. Hence, it is unclear where Adam obtained this data and this would imply an entire team of investigators, researchers, medical professionals at the FDA somehow overlooked these standards in their PDUFA green light to Bremo.

Statistically minded readers may point out, however, that there exists a large standard deviation of satisfying sexual events (SSEs) to efficacy in Bremo. While it is entirely possible for one patient to experience no improvement and another to experience over 5 SSEs after treatment, the p value being less than 0.05 concludes the drug is at least likely to be non-random due to the endpoint average of the treated sample being more significant than the placebo population even adjusted for standard deviation.

In addition, readers with a pharmaceutical background may further point out the p value being less than 0.05 is not as good as p value being than 0.01, where the latter can definitively conclude the drug works and randomness is mitigated. To respond to this, the author has pulled up a second clinical trial to analyze.

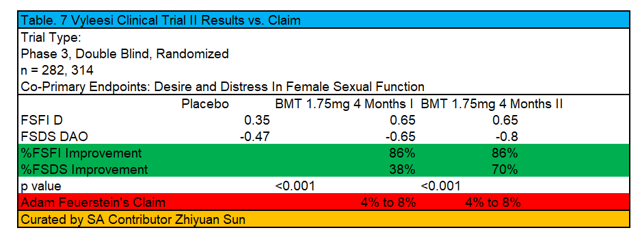

Again, the author has curated the results into the following table:

As we can see, desire and distress in female sexual dysfunction post treatment of 1.75mg Bremo treatment after 4 months range from 38% to 86% improvement in these primary endpoints versus placebo. This estimate is nowhere near the 4% to 8% claimed in Adam Feuerstein's bearish article about the drug. Moreover, the p values of this study amounted to less than 0.001, which more than concludes the drug's active pharmaceutical ingredient has efficacy over placebo. Sure, one may disagree about the global vs. local efficacy of the drug (i.e., why the number of SSEs wasn't 2 versus 0.8 post treatment), but that is a question regarding the appropriate dosage administered and not whether or the drug actually works.

As we will see below, Vyleesi not only works, but is surprisingly safe:

Firstly, it is important to note nausea is not a serious adverse event. In terms of SAEs, the highest dose of Bremo only reported 1% while 3% of patients treated with placebo had such response. Moreover, only 18 to 25% of patients in this trial has reported nausea. It is important for investors to note every single drug in the world has some kind of adverse effects during treatment. The FDA does not approve a drug only if the drug is perfect and has absolutely zero risks and downsides, but because the rewards (efficacy) outweigh the risks (adverse reactions).

To put it into perspective, the author has pulled historical clinical trials exploring the safety of Viagra.

As shown in this chart, the number of adverse events for Viagra ranges from 20% to 83% depending on dosage, with multiple serious and severe reactions causing discontinuations. With this in mind, this is a drug which is universally prescribed for treatment of erectile dysfunction in men and much enjoyed by patients. To ignore a drug's risk-reward profile and deny its benefits solely because the drug cannot meet perfection in terms of safety is completely absurd.

Furthermore, let's compare Bremelanotide's safety profile to that of its competitor, Addyi:

Addyi was a drug developed by Sprout Pharmaceuticals in 2015 as the first ever treatment for female HSDD. The drug has been a major flop, being acquired by Valeant Pharmaceuticals in 2015 for $1 Billion, only for it to generate $13 million in sales in 2017. This is largely due to its restrictive pricing (being 10x more expensive than a prescription of Viagra) and post-marketing clinical trials revealing a dangerous side effect (hypotension) when taken in conjunction with alcohol. The label restrictions added as of April 2019 would further constraint its revenue to Sprout Pharma.

Regarding the side effects of Bremo when used before or after alcohol intake, the author was only able to find the following information:

This study revealed no significant increase in incidences of adverse events when Bremelanotide was taken co-administered with alcohol. However, investors should definitely take a step back and not get too excited about this result. I know, I talked about a lot of good things with the drug, but the author believes this is the only part from Adam's article which raises a legitimate concern. Why this is will be explained below:

As we can see from the image, the study only had 24 participants with 12 patients being inexplicably male. In addition, this was only a phase 1 study and involves a different method of delivery for Bremelanotide. After some digging, the author has found intranasal Bremo to be a dangerous delivery method for this drug, with patients reporting hypertension post treatment and the FDA ultimately halted its development due to the aforementioned safety concerns. Therefore there is currently no clinical data regarding the synergistic effects of administering intravenous Bremo and alcohol use. This is quite a significant insight from Adam as statistics suggest roughly 33% of the population use alcohol before sexual intercourse. As of today, AMAG has no clinical trials evaluating this safety metric aside from a phase 1 post-marketing trial regarding Bremo and nausea. If the FDA requests more clinical trials evaluating the safety of Bremo after drinking and or the trial data comes out negative as to require a label restriction, shareholders should be prepared to see material declines in the stock price due to large revenue revisions. Adam Feurestein deserves credit for being skeptical regarding this one. For now, let's investigate the skepticism regarding the drug's method of delivery:

The comparable precedent as to whether or not female patients are satisfied with intravenous injections is Allergan's (AGN)'s Botox. Despite a painful injection and various adverse events, this drug remains the primary standard of care in women's cosmetics and even long after patent expiry, continues to generate over $2.5 Billion in sales as of FY2018 (as it is a trade secret). Furthermore, the drug is still generating double digit % revenue growth Y/Y. Hence, the author finds female patients "fearing" intravenous deliveries of gynecological drugs to be a myth, and sees no reason why such claim could be applied to Bremelanotide's method of delivery.

After an analysis of Bremelanotide's clinical date and economics, the author concludes Vyleesi to be a safe and efficacious drug which addresses a huge patient size with unmet medical needs regarding HSDD. In regards to Adam Feurestein's article, the author finds the biotech journalist has done an amazing job of outlining the potential FDA oversight of Bremelanotide's synergistic effects when taken with alcohol, yet presented a string of estimates that I disagree with in regards to the drug's efficacy and other safety metrics. In my assessment, 4 out the 5 claims raised by Adam are demonstrably false based on the assessment of clinical and financial evidence, while the last claim actually raises a potential risk shareholders may have overlooked amid the approval hype. Investors therefore should be both celebratory in regards to AMAG and PTN's drug approval and be aware of additional R&D expenses in regards to potential FDA post-marketing clinical trial requests.

Special thanks to SA user --jwm-- for informing me of this article idea.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AMAG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Market trend • Information • Data • AMAG Pharmaceuticals • NASDAQ • Therapy • Hypoactive sexual desire disorder • Food and Drug Administration • Drug • Bremelanotide • Bremo Historic District • Bremelanotide • Pleiotrophin • AMAG Pharmaceuticals • Phases of clinical research • Clinical trial • Drug • Pharmacovigilance • Efficacy • Drug • Food and Drug Administration • Motion of no confidence • Biotechnology • Market trend • Food and Drug Administration • Science • Economics • Medicine • Data • Mental representation • Point of view (philosophy) • Bremelanotide • Clinical trial • Chutzpah • Food and Drug Administration • AMAG Automobil- und Motoren • Pleiotrophin • Royalty payment • AMAG Automobil- und Motoren • Contract • Royalty payment • Financial adviser • Greenhill & Co. • Limited liability company • Bremo Historic District • North America • Patent • AMAG Automobil- und Motoren • Intellectual property • Royalty payment • Contract • Royalty payment • Contract • North America • Bremelanotide • Marketing • Europe • Asia • Oceania • Africa • Let's Move! • Information • Patient • Research • Epidemiology • Disease • Statistical population • United States • Food and Drug Administration • Approved drug • Pharmaceutical industry • Flibanserin • Patent • Patient • Drug • Sildenafil • Sildenafil • Bremo Historic District • Price • Sildenafil • Patent • Generic drug • Brand • Prescription drug • Sildenafil • Patent • Benchmarking • Royalty payment • Pleiotrophin • AMAG Automobil- und Motoren • Marketing • S86 (Berlin) • AMAG Automobil- und Motoren • United States • Volvo S90 • AMAG Automobil- und Motoren • Market trend • Market trend • Bremo Historic District • European Union • United Kingdom • Canada • Australia • New Zealand • Japan • Interest rate • Sildenafil • Mechanism of action • Memorandum of understanding • Bremo Historic District • Clinical trial • Drug • Questionnaire • Human sexual activity • Observation • Erection • Sildenafil • Value (ethics) • Bremo Historic District • Therapy • Placebo • Libido • Efficacy • Suffering • Food and Drug Administration • Phases of clinical research • Blinded experiment • Randomized controlled trial • Bremo Historic District • Placebo • Bremo Historic District • Pharmaceutical drug • Efficacy • Placebo • Food and Drug Administration • Prescription Drug User Fee Act • Bremo Historic District • Standard deviation • Efficacy • Bremo Historic District • Therapy • P-value • Drug • Randomness • Clinical endpoint • Arithmetic mean • Sampling (statistics) • Placebo • Statistical population • Standard deviation • Pharmaceutical drug • P-value • P-value • Randomness • Clinical trial • Female sexual arousal disorder • Bremo Historic District • Therapy • Clinical endpoint • Placebo • Market trend • Drug • P-value • Experiment • Drug • Active ingredient • Efficacy • Placebo • Efficacy • Drug • Therapy • Dose (biochemistry) • Drug • Nausea • Serious adverse event • Apold • Dose (biochemistry) • Bremo Historic District • Patient • Placebo • Patient • Clinical trial • Nausea • Drug • Adverse effect • Therapy • Food and Drug Administration • Drug • Drug • Reward system • Efficacy • Risk • Adverse drug reaction • Clinical trial • Pharmacovigilance • Sildenafil • Adverse effect • Sildenafil • Dose (biochemistry) • Mind • Drug • Therapy • Erectile dysfunction • Patient • Drug • Health • Drug • Bremelanotide • Pharmacovigilance • Competition • Flibanserin • Flibanserin • Drug • Valeant Pharmaceuticals • Medical prescription • Sildenafil • Marketing • Clinical trial • Risk • Side effect • Hypotension • Alcohol • Regulation • Pharmaceutical industry • Adverse effect • Bremo Historic District • Alcohol • Adverse effect • Bremelanotide • Alcohol • Bremelanotide • Nasal administration • Bremo Historic District • Childbirth • Scientific method • Drug • Patient • Hypertension • Therapy • Food and Drug Administration • Drug development • Pharmacovigilance • Clinical trial • Synergy • Intravenous therapy • Bremo Historic District • Alcohol • Statistics • Alcohol • Sexual intercourse • AMAG Automobil- und Motoren • Clinical trial • Pharmacovigilance • Phases of clinical research • Bremo Historic District • Nausea • Food and Drug Administration • Clinical trial • Bremo Historic District • Regulation • Patient • Intravenous therapy • Injection (medicine) • Allergan • Active galactic nucleus • Botulinum toxin • Pain • Injection (medicine) • Adverse effect • Drug • Primary standard • Standard of care • Cosmetics • Patent • Trade secret • Intravenous therapy • Childbirth • Gynaecology • Drug • Bremelanotide • Scientific method • Childbirth • Psychoanalysis • Bremelanotide • Medicine • Economics • Efficacy • Drug • Patient • Medicine • Biotechnology • Food and Drug Administration • Regulation • Bremelanotide • Synergy • Alcohol • Drug • Efficacy • Pharmacovigilance • Evidence • Risk • Hype cycle • AMAG Automobil- und Motoren • Pleiotrophin • Research and development • Food and Drug Administration • Marketing • Clinical trial • JWM • Corporation • Stock market • AMAG Automobil- und Motoren • Seeking Alpha • Stock •