Wanda Sport Group Begins U.S. IPO Efforts - 9 minutes read

Wanda Sport Group Begins U.S. IPO Efforts - Wanda Sports Group (Pending:WSG)

Wanda Sport Group Begins U.S. IPO Efforts - Wanda Sports Group (Pending:WSG)Wanda Sports Group has filed to raise $500 million in a U.S. IPO.

The company is a large global operator of mass participation sports events and related services.

WSG has an enviable position in the industry but its growth and other financial metrics have decelerated sharply in the most recent period.

Wanda Sports Group (WSG), the sports and live events unit of Dalian Wanda Group has filed to raise gross proceeds of up to $500 million from a U.S. IPO, according to an F-1 registration statement.

The firm, part of the Dalian Wanda Group, is a global sports events, media, and marketing platform.

WSG is a large entity in the industry but its growth has slowed markedly and the firm is generating net losses and using cash in operations.

I’ll provide an update when we learn more IPO details from management.

Beijing, China-based Wanda Sports was founded to unite people in sports and enable athletes and their fans to live their passions and dreams.

Management is headed by President, CEO and Director Hengming Yang, who has been with the firm since 2016 and was previously President and the Chairman of BP [China] Investment Holdings.

Wanda acquired Infront Sports & Media in 2015, a Zug, Switzerland-based sports marketing company and WEH [World Endurance Holdings], a Tampa, Florida-based triathlon and endurance event services company, and established WSC in Beijing, China to provide a sports events, media, and marketing platform in China.

According to management, as of Dec. 31st, 2018, Wanda had worked with more than 160 rights owners, 120 media broadcasters, and over 750 brands.

Management claims that, according to a Frost & Sullivan report, Wanda Sports was the largest provider of events in triathlon, mountain biking and running globally, based on revenue and number of events organized in 2018, the number one full-service sports marketing company based on sports covered in 2018, and the number two full-service sports marketing company based on revenue in 2018.

Additionally, it claims to be the second global digital, production and sports solutions company based on revenue in 2018, according to the Frost & Sullivan report.

Wanda Sports has built a global sports event portfolio of globally-recognized brands and related intellectual properties in mass-participation sports owned by WEH, such as triathlon, running and mountain biking, which the firm complements with personal and corporate fitness as well as other events, including obstacle course racing, owned by Infront.

The company’s media services include media production and distribution of sports content in the form of live coverage, host broadcasting, programming, archive services, and digital solutions.

According to management, Wanda delivered a total of 3,700 event days for its partners in 2018.

Wanda Sports’ primary revenue source is from event entry fees and other event-related fees, such as host city fees. Otherwise, the firm monetizes its intellectual properties through sponsorship, event and product licensing, merchandising and media distribution opportunities.

Wherever the firm doesn’t own the intellectual property relating to sports events, it enters into rights-in and rights-out agreements to profit from media distribution, sponsorship, and marketing activities.

The firm has established the Brands 360 international sales department which is focused on reaching brands in markets where Wanda does not have a consistent presence or that it has identified as having additional potential.

The department's tasks include creating new revenue source through sponsorship sales, building a well-positioned and profitable virtual ad sales unit, driving additional revenue for its current rights, positioning the company for future rights, and establishing a testing ground for its sales as well as creating an integrated team.

Selling, Office & Admin expenses as a percentage of revenue have been uneven, per the table below:

The sales efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of selling, office & admin spend, has dropped markedly in the most recent period to 0.6x from 3.4x, as shown in the table below:

According to a 2017 market research report by Tecnavio, the global sporting events market is projected to grow at a CAGR of 3.58% between 2017 and 2021.

The main factors driving market growth include the increasing passion of individuals for sports, which has resulted in the formation of teams representing various countries or regions, and the rise in disposable income, among other factors.

According to another 2019 market research report by The Business Research Company, the global sports market was valued at $488.5 billion in 2018, growing at a CAGR of 4.5% between 2014 and 2018.

Major competitors that provide or are developing sporting events include:

WSG’s recent financial results can be summarized as follows:

Below are relevant financial metrics derived from the firm’s registration statement:

As of March 31, 2019, the company had $209.7 million in cash and $1.9 billion in total liabilities. (Unaudited, interim)

Free cash flow during the twelve months ended March 31, 2019, was $3.6 million

WSG intends to raise $500 million in gross proceeds from an IPO of its ADS representing underlying Class A shares.

Class A shareholders will be entitled to one vote per share and Class B holders four votes per share.

Multiple classes of stock are a way for either management or existing shareholders to retain voting control of the company after losing economic control.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Per the firm’s latest filing, it plans to use the net proceeds from the IPO as follows:

Management’s presentation of the company roadshow is not available yet.

Listed underwriters of the IPO are Morgan Stanley, Deutsche Bank Securities, Citigroup, Haitong International, CICC, and CLSA.

WSG is attempting to access U.S. capital markets for capital to essentially pay down its significant debt load.

Notably, management said little about its expansion plans other than generic language about expanding into further geographic markets.

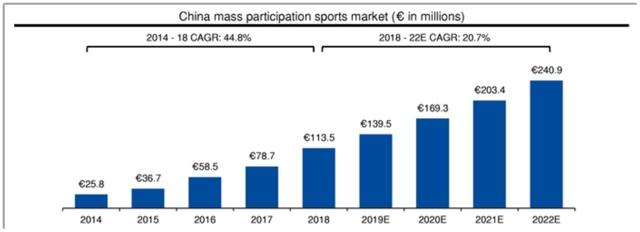

As to its China expansion plans, management paints a rosy picture of its market forecast, but provides no source for the information:

The firm’s financials show a decelerating pattern over the past few years, with a swing to negative net profit and cash used in operations.

Normally an IPO candidate shows strong growth in the period leading up to the IPO, whereas Wanda is showing waning growth.

Sales and marketing expenses as a percentage of total revenue have been uneven and the firm’s sales efficiency has dropped markedly.

The market opportunity for ‘mass participation’ sporting events is difficult to quantify. While sporting events are growing on a global basis, it isn’t clear that that growth is translating into a strong market opportunity for WSG’s focus.

On the legal side, like many Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

I’ll provide a final opinion when we learn more details about the IPO from management, but from what I’ve seen so far, the IPO appears rather mediocre as a growth story.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: Seekingalpha.com

Powered by NewsAPI.org

Keywords:

Initial public offering • United States dollar • Initial public offering • Corporation • Multinational corporation • Management • Service (economics) • Industry • Economic growth • Measurement • Wanda Group • Initial public offering • Wanda Group • Mass media • Marketing • Legal personality • Industry • Economic growth • Business • Internet • Money • Business operations • Initial public offering • Management • Beijing • Sport • Management • President • Chief executive officer • Chief executive officer • President • Chairman • BP • China • Investment • Wanda Group • Infront Sports & Media • Switzerland • Sports marketing • Tampa, Florida • Triathlon • World Sportscar Championship • Beijing • Mass media • Marketing • Management • Mass media • Broadcasting • Brand • Management • Frost & Sullivan • Sport • Sport • Triathlon • Mountain biking • Manufacturing • Corporation • Frost & Sullivan • Multinational corporation • Intellectual property • Sport • Triathlon • Mountain biking • Sport • Obstacle racing • Company • Broadcasting • Distribution (business) • Sport • Content (media) • News • Broadcasting • Computer programming • Service (economics) • Management • Revenue • Sport • Fee • Business • Intellectual property • Sport • Product (business) • License • Product (business) • Mass media • Distribution (business) • Business • Intellectual property • Sport • Copyright • Copyright • Contract • Mass media • Distribution (business) • Sponsor (commercial) • Marketing • Business • Brand • Sales • Brand • Market (economics) • Revenue • Sales • Profit (accounting) • Advertising • Sales • Revenue • Company • Intellectual property • Experiment • Sales • Sales • Office • Business administration • Expense • Percentage • Revenue • Sales • Efficiency • Interest rate • Revenue • United States dollar • Market research • Multinational corporation • Compound annual growth rate • Disposable and discretionary income • Market research • Business • Corporation • Multinational corporation • Sport • Compound annual growth rate • Sport • Finance • Finance • Business • Company • Free cash flow • Initial public offering • Office • Office • Shareholder • Office • Voting • Share (finance) • Social class • Stock • Management • Shareholder • Voting • Company • S&P 500 Index • Business • Stock • Business • Internet • Initial public offering • Management • Company • Public company • Underwriting • Initial public offering • Morgan Stanley • Deutsche Bank • Citigroup • EBay • China International Capital Corporation • CLSA • Capital market • Debt • Market (economics) • China • Management • Image • Market (economics) • Information • Business • Finance • Pattern • Money • Initial public offering • Initial public offering • Sales • Marketing • Business • Sales • Market analysis • Market analysis • China • Legal personality • Market (economics) • Business • Variable interest entity • Investor • Business • Contract • Business • Business operations • Asset • Law • Risk • Management • Contract • Investment • Initial public offering • Uncertainty • Initial public offering • Initial public offering • Corporation • Stock • Seeking Alpha • Stock market •